The cryptocurrency revolution has minted billionaires at unprecedented speeds and ages. Unlike traditional wealth built over decades through established industries, crypto has allowed technically brilliant twenty-somethings to amass fortunes almost overnight.

In this article, we’ll explore the remarkable phenomenon of cryptocurrency’s youngest billionaires. We’ll identify who currently holds the title of youngest crypto billionaire, examine the seven individuals who achieved billionaire status at surprisingly young ages, and analyze their journeys from obscurity to extreme wealth.

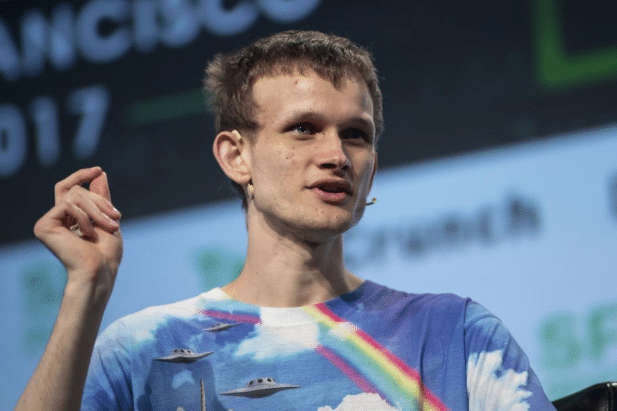

Who is the Youngest Crypto Billionaire?

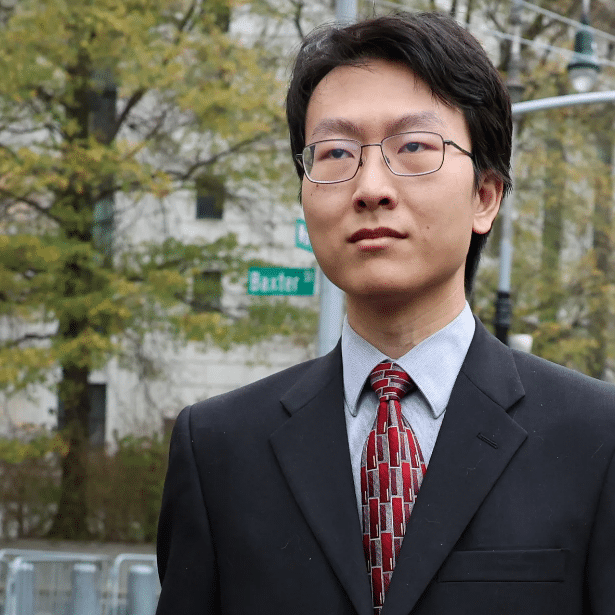

The title of youngest crypto billionaire belongs to Vitalik Buterin, who reached billionaire status at just 27 years old in 2021. As co-founder of Ethereum, the second-largest cryptocurrency platform after Bitcoin, Buterin created a blockchain platform that revolutionized the industry by enabling smart contracts and decentralized applications.

Born in Russia and raised in Canada, Buterin was introduced to Bitcoin in his teens and quickly became fascinated by blockchain technology. Rather than simply using existing platforms, he envisioned something more versatile – a “world computer” that could run programmable applications on a blockchain. This vision became Ethereum, launched when Buterin was just 21.

Unlike many tech billionaires who aggressively pursue wealth, Buterin is known for his modest lifestyle and genuine commitment to blockchain’s idealistic potential. His fortune stems primarily from his holdings of Ethereum’s native token (ETH), with his wallet reportedly containing approximately 333,520 ETH – worth well over $1.5 billion depending on market conditions.

Top 7 Youngest Crypto Billionaires of All Time

The cryptocurrency revolution has created a unique class of young billionaires who achieved extraordinary wealth through various blockchain innovations. These individuals represent how digital assets have democratized wealth creation for those with technical vision.

| Rank | Name | Age at Billionaire Status | Peak Net Worth | Primary Venture |

|---|---|---|---|---|

| 1 | Vitalik Buterin | 27 (2021) | $1.5B+ | Ethereum (Co-founder) |

| 2 | Gary Wang | 28 (2022) | $1.2B | FTX (Co-founder) |

| 3 | Sam Bankman-Fried | 29 (2021) | $22.5B | FTX/Alameda Research |

| 4 | Hayden Adams | 29 (2021) | $1.8B | Uniswap (Founder) |

| 5 | Ed Craven | 29 (2023) | $2.8B | Stake.com |

| 6 | Devin Finzer | 31 (2022) | $2.2B | OpenSea |

| 7 | Nikil Viswanathan | 33 (2022) | $1.1B | Alchemy |

1. Vitalik Buterin

Vitalik Buterin remains a leading figure in blockchain innovation as Ethereum’s co-founder. Despite facing competition from newer blockchains, he focuses on technical improvements like proto-danksharding to make Ethereum faster and cheaper to use.

Buterin champions privacy tools and decentralized governance while maintaining a modest lifestyle despite his wealth. His fortune fluctuates with Ethereum prices, but typically exceeds $1.5 billion. Rather than pursuing corporate roles, he prefers guiding Ethereum’s technical vision and donating to causes like COVID-19 relief and legal defense funds for developers. His approach to wealth and technology has made him one of the most respected figures in the industry.

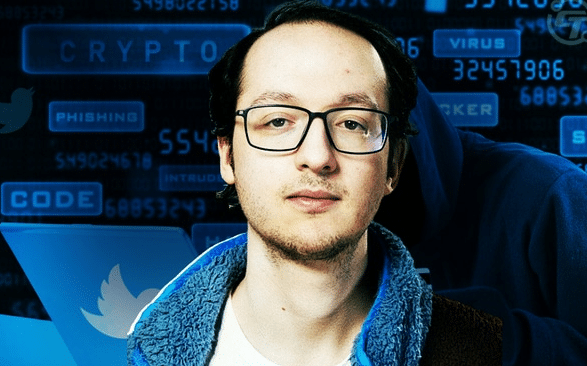

2. Gary Wang

Gary Wang, once worth $1.2 billion as FTX’s co-founder and chief technology officer, has experienced a dramatic reversal of fortune. Currently serving a 7-year prison sentence after pleading guilty to fraud charges in 2023, Wang’s wealth evaporated with FTX’s collapse.

He owned 16% of FTX at its peak $32 billion valuation but lost everything following the exchange’s bankruptcy. Wang cooperated with prosecutors and testified against his former partner Sam Bankman-Fried. His technical skills, once used to build one of crypto’s largest exchanges, are now restricted under parole terms, and he faces asset forfeiture and lifetime bans from cryptocurrency trading.

3. Sam Bankman-Fried (SBF)

Sam Bankman-Fried, formerly crypto’s wealthiest individual with a peak net worth of $22.5 billion, is now serving a 25-year prison sentence for fraud, money laundering, and conspiracy. As FTX’s CEO, he built the world’s third-largest cryptocurrency exchange before its catastrophic 2022 collapse, which left an $8 billion customer deficit.

Once the poster child of “effective altruism” and a major political donor, SBF now resides in a medium-security prison while appealing his conviction. His parents face lawsuits over allegedly misappropriated funds, including a $16 million Bahamas property. Though his reputation is permanently damaged, he maintains a small online following debating his motivations and legacy.

4. Hayden Adams

Hayden Adams, founder of Uniswap, continues to lead decentralized finance innovation with a net worth around $1.8 billion. His creation, Uniswap, processes over $2 billion in daily trading volume as the world’s largest decentralized exchange. Adams actively advocates for regulatory clarity while battling SEC lawsuits regarding the classification of Uniswap’s UNI token.

Under his leadership, Uniswap Labs recently launched Uniswap X, an improved cross-chain swap protocol, and a wallet designed for mainstream adoption. Despite market volatility, Adams focuses on strengthening DeFi infrastructure, including tools to protect users from unfair transaction ordering. His wealth primarily derives from UNI tokens and protocol fees.

5. Ed Craven

Ed Craven, co-founder of crypto gambling platform Stake.com, has built his $2.8 billion fortune through digital betting innovation. His platform processes over $100 billion in annual bets and sponsors major sports franchises like Everton FC. While strategically avoiding the regulated U.S. market, Craven dominates gambling in Asia and Europe by seamlessly integrating both cryptocurrency and traditional payment methods.

Stake.com generates over $4 billion in yearly revenue despite criticism about gambling’s social impacts. Recently, Craven launched Stake.us, a social casino for American users that navigates gambling regulations. Unlike many flamboyant gambling moguls, Craven maintains a relatively low public profile while steadily expanding his wealth and business reach.

6. Devin Finzer

Devin Finzer, OpenSea’s CEO, has faced challenging market conditions with his net worth declining to approximately $800 million from a peak of $2.2 billion. OpenSea, once valued at $13.3 billion, has experienced a 90% valuation drop following the 2022 NFT market collapse.

Finzer has responded with strategic pivots, including layoffs and the launch of OpenSea 2.0 featuring gas-free trading. He battles increasing competition from platforms like Blur while advocating for NFT copyright reforms. Despite market skepticism about NFTs’ future, OpenSea remains the largest marketplace in the space, processing about $200 million in monthly volume. Finzer’s wealth remains closely tied to his equity stake and OpenSea’s uncertain prospects.

7. Nikil Viswanathan

Nikil Viswanathan, Alchemy’s CEO, has built what many call the “AWS of Web3” with a personal fortune of $1.1 billion. His company, valued at $10.2 billion, provides essential infrastructure powering major blockchain applications including Ethereum, Polygon, and MetaMask. Alchemy generates over $15 billion in annual revenue by focusing on institutional adoption and recently launched Alchemy Pay for enterprise blockchain solutions.

Unlike many crypto entrepreneurs, Viswanathan has maintained profitability through market downturns by providing essential developer tools rather than speculative assets. He emphasizes regulatory compliance and has secured partnerships with established companies like Disney and Adobe, positioning himself as a stable presence in the volatile cryptocurrency sector.

Suggested Reads:

- Most Expensive Cryptocurrencies In The World

- How Many Cryptocurrencies Are There?

- Top Crypto-Friendly Banks Worldwide

Conclusion: Vitalik Buterin is the youngest crypto billionaire

The stories of crypto’s youngest billionaires reveal the unprecedented wealth creation possible in the digital asset space, but also highlight its extreme volatility and risks. From Vitalik Buterin’s continued innovation to the dramatic falls of SBF and Gary Wang, these narratives showcase both the transformative potential and pitfalls of the cryptocurrency revolution.

As the industry continues evolving, these stories serve as both inspiration and caution. They demonstrate how technical brilliance combined with vision can create enormous value, while also revealing how quickly fortunes can disappear when divorced from ethical foundations. For the next generation of innovators, these seven individuals offer valuable lessons about the promises and perils of building in this dynamic, transformative space.

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)