Cryptocurrency value derives from multiple interconnected factors rather than traditional backing mechanisms like those supporting fiat currencies. The foundation of cryptocurrency value rests on blockchain technology, creating trustless, decentralized networks with properties similar to both currencies and commodities.

Unlike government-issued money, cryptocurrencies derive worth from their utility, scarcity, network effects, and market perception. These digital assets represent a shift in how value can be created, transferred, and stored in the digital economy.

Understanding these valuation mechanisms is crucial for investors, policymakers, and technologists navigating this evolving asset class in 2025’s increasingly digitized financial market.

So let us get right into all the details.

What Gives Cryptocurrency Value? [TLDR]

Cryptocurrency value stems from scarcity, utility, network effects, decentralization, and security. Unlike traditional assets, crypto blends currency and tech innovation, offering financial freedom and new economic models. In 2025, growing adoption and regulation are refining these drivers beyond speculation into long-term, functional value.

The Role of Utility and Adoption in Crypto Valuation

Cryptocurrency value depends heavily on its practical utility. Coins with clear real-world uses tend to hold value better.

This model’s importance has increased in the 2025 maturing crypto ecosystem. By 2025, about 28% of American adults, or 65.7 million people, will own cryptocurrency in the U.S., rising from 15% in 2021, indicating confidence after the “crypto winter” of 2022.

This rise in adoption shows how utility correlates with value as more people find cryptocurrencies useful for various financial activities.

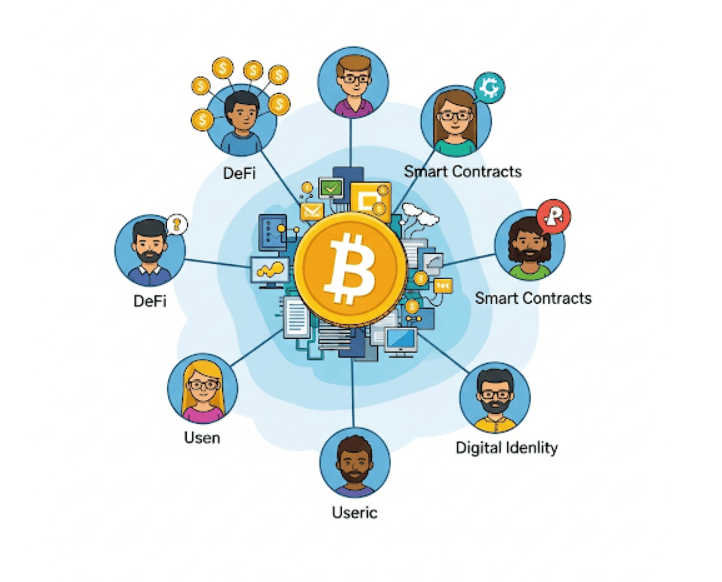

Perceived usefulness mediates the relationship between awareness and adoption decisions, with trust being crucial for broader acceptance. Utility includes:

- Decentralized finance (DeFi) for lending and yield generation

- Smart contracts automating agreements

- Digital identity verification, supply chain tracking

- Tokenization of assets like real estate.

Value from these functions grows with network effects. Cryptocurrency’s utility and value increase as more users join.

For instance, Solana’s market value has grown, with 17% of crypto customers planning to buy in 2025, partly due to its efficient “proof-of-history mechanism” enabling 65,000 transactions per second.

The Core Principle Behind Crypto Pricing

Cryptocurrency pricing relies on supply and demand dynamics, but with unique characteristics. Understanding these principles is vital for grasping crypto market functions and value establishment.

When an asset is scarce but many people want it, the price of that asset will rise. Conversely, the price will fall if there is a larger supply of an asset than the consumer demand warrants.

This applies to cryptocurrencies, though there are nuances. Unlike traditional currencies, many cryptocurrencies have predetermined supply schedules.

Bitcoin’s supply is capped at 21 million coins, with a decreasing issuance rate through “halving” events every four years. This predictable scarcity creates deflationary pressure as demand grows against a limited supply.

Cryptocurrency pricing occurs on exchanges, where buyers and sellers converge. Price discovery happens continuously through matching buy and sell orders, with no central authority dictating the “correct” price. This results in a market-driven pricing model that can lead to significant volatility as sentiment shifts.

Several factors uniquely influence cryptocurrency pricing:

- Software upgrades and protocol changes affecting security or scalability

- Technological innovations enabling new capabilities

- Regulatory developments across different jurisdictions

- Network security and resilience against attacks

- Community governance decisions affecting tokenomics

These price determinants operate alongside traditional economic factors to create a complex but increasingly mature pricing ecosystem as cryptocurrencies enter their second decade of existence in 2025.

Who Controls the Value of Cryptocurrency?

Cryptocurrencies are decentralized, with no central authority controlling supply or protocol changes. Value arises from the collective actions of developers, miners, investors, users, exchanges, and regulators. Exchanges and media coverage significantly impact market sentiment and pricing.

Let us check them out in depth:

1. Decentralization: No Central Authority

True cryptocurrencies lack a central controlling entity. No government, corporation, or individual has the power to create new units, change protocol rules, or manipulate blockchain history. Instead, these networks function via distributed consensus, requiring multiple parties to agree on the system’s state.

This decentralization creates value through:

- Resistance to censorship and unilateral control

- Protection against arbitrary inflation or currency manipulation

- Reduced counterparty risk compared to centralized financial systems

- Increased resilience against single points of failure

- Greater transparency in monetary policy and governance

2. Role of Developers, Miners, Investors, and Community Sentiment

Cryptocurrency value emerges from the collective actions and decisions of diverse stakeholders, each playing a distinct role in the ecosystem:

- Developers: Engineers who build and maintain the underlying code that governs how a cryptocurrency functions

- Miners/Validators: Entities that secure the network and process transactions in exchange for rewards

- Investors: Individuals and institutions who purchase and hold cryptocurrencies as assets

- Users: People and organizations who utilize cryptocurrencies for practical purposes

- Exchanges: Platforms that facilitate trading and provide liquidity to the market

- Regulators: Government entities that establish legal frameworks for cryptocurrency operation

Interactions among stakeholders create a dynamic ecosystem where value is negotiated.

For example, developers propose improvements, miners decide on implementation, investors assess continued investment, and users evaluate cryptocurrency relevance.

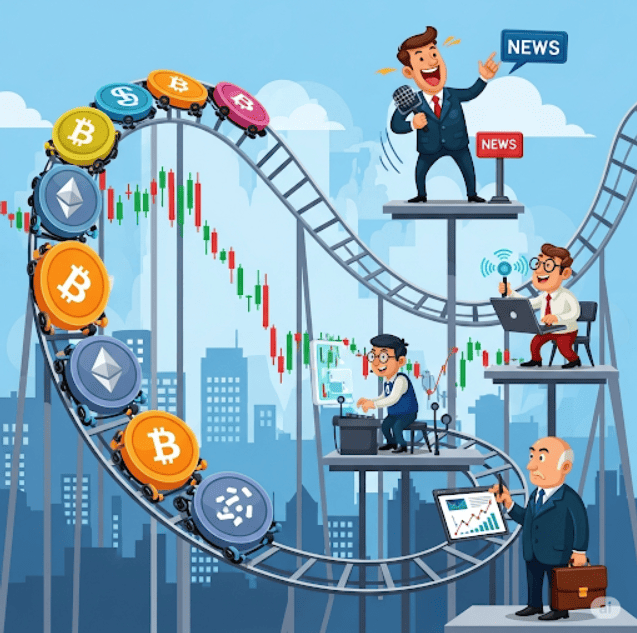

3. Influence of Crypto Exchanges and Media

Cryptocurrency exchanges are crucial for price discovery and trading, significantly influencing value. Major exchanges like Coinbase, Binance, and Kraken facilitate transactions and legitimize listed assets. Their selection of supported cryptocurrencies can greatly affect market valuations.

Media coverage and social media sentiment greatly affect cryptocurrency valuations in volatile markets. Positive coverage can trigger rapid price increases, while negative news often leads to significant sell-offs, overshadowing the fundamental relevance of reported events.

This media influence creates a feedback loop where:

- News coverage affects market sentiment

- Market movements generate further media attention

- Additional investors enter or exit based on coverage

- Price movements accelerate in response to changing participation

The mature cryptocurrency market of 2025 has developed more sophisticated responses to media influence, but sentiment remains a crucial determinant of short to medium-term value fluctuations.

Competition Between Cryptocurrencies

The cryptocurrency market in 2025 features intense competition between thousands of digital assets, each vying for market share, developer talent, and user adoption. This competitive environment significantly influences how value is distributed across the ecosystem and drives continuous innovation.

This competitive dynamic creates several value implications:

- Network effects tend to concentrate value in cryptocurrencies with the largest user bases

- Specialized cryptocurrencies can capture value by addressing specific use cases more effectively

- Innovation in one project often drives improvements across the ecosystem

- Interoperability between cryptocurrencies creates value through network expansion

- Competition for developers and technical talent accelerates technological progress

The zero-sum nature of cryptocurrency competition means that gains for one asset often come at the expense of others. However, the cryptocurrency market’s expansion in 2025 has allowed multiple successful projects to exist by addressing various market segments.

The rise of cross-chain technologies and interoperability protocols has reduced direct competition, enabling value to flow more efficiently between ecosystems. This evolution shows a maturing market where cooperation and competition coexist.

How Governance Impacts Investor Confidence?

Effective governance fosters investor trust through transparency, dispute resolution, and balanced stakeholder involvement. It can be centralized or decentralized, as seen in autonomous organizations (DAOs).

Projects with strong governance often have higher valuations due to lower risk and better long-term prospects.

Effective governance systems provide:

- Clear processes for decision-making about protocol changes

- Transparent mechanisms for resolving disputes

- Balanced representation of stakeholder interests

- Accountability for development teams and foundations

- Predictable pathways for protocol upgrades and improvements

What Gives Bitcoin Its Value?

Bitcoin’s value stems from unique features that set it apart from traditional assets and other cryptocurrencies.

1. Bitcoin as “Digital Gold”

Called “digital gold,” Bitcoin shares key traits with gold:

- Scarcity: Fixed supply of 21 million coins

- Durability: Digital and permanent

- Divisibility: Can be split into 100 million satoshis

- Portability: Instantly transferable worldwide

- Authenticity: Verified via blockchain

This makes Bitcoin attractive as an inflation hedge and store of value.

2. Limited Supply and Store of Value

Bitcoin’s capped supply creates scarcity, driving long-term value as demand rises. Unlike commodities, supply won’t increase with demand, ensuring a fixed monetary policy known to all users.

3. Institutional Adoption and Recognition

Growing institutional interest—from corporate treasuries to Bitcoin ETFs and sovereign funds—boosts Bitcoin’s legitimacy. Recent political developments and legal recognition in various countries further strengthen its position as a global asset and medium of exchange.

What Is the Value of Bitcoin in US Dollars Right Now?

As of 2025, Bitcoin’s price has experienced significant changes compared to previous years. While exact price points fluctuate by the minute, recent market developments provide context for understanding current valuations.

Current BTC Price Trends

As of 2025, Bitcoin’s price remains highly volatile but reflects long-term bullish trends. Key events shaping its current value include the 2024 halving, spot Bitcoin ETF launches, global regulations, inflation, and Bitcoin protocol upgrades.

Analysts predict highs of $150K–$200K, citing stronger institutional adoption and market maturity.

Bitcoin’s price trajectory in 2025 has been influenced by several major events over the preceding year:

- The April 2024 halving event that reduced the block reward from 6.25 to 3.125 BTC

- Approval and launch of spot Bitcoin ETFs, increasing institutional access

- Regulatory developments across major economies

- Macroeconomic factors including inflation rates and monetary policy

- Technological upgrades to the Bitcoin protocol

Factors Affecting Its USD Price

Multiple factors continue to influence Bitcoin’s dollar value in 2025:

- Institutional demand: The entrance of traditional financial institutions into the Bitcoin market has created sustained buying pressure from entities with long investment horizons.

- Regulatory environment: Clearer regulatory frameworks in major jurisdictions have reduced uncertainty and enabled broader participation in Bitcoin markets.

- Macroeconomic conditions: Bitcoin’s perceived role as an inflation hedge has made its price sensitive to monetary policy decisions and inflation data.

- Technological developments: Ongoing improvements to Bitcoin’s scalability and security continuously refine its value proposition.

- Global adoption: The increasing use of Bitcoin for international remittances, commerce, and as a store of value in countries with unstable currencies creates organic demand.

- Market sentiment: Despite maturation, Bitcoin’s price remains influenced by changing investor sentiment and speculative activity.

These factors create a complex pricing environment with short-term volatility and long-term value appreciation driven by Bitcoin’s fundamentals and adoption.

What Causes Cryptocurrency to Rise and Fall?

Cryptocurrency prices fluctuate due to numerous factors, ranging from market fundamentals to speculative behavior. Understanding these price drivers helps investors navigate the cryptocurrency landscape more effectively.

1. Market Sentiment

Crypto prices swing with investor mood, driven by social media, FOMO, technical charts, and hype cycles. Smaller market caps make them sensitive to fast shifts in sentiment.

2. Regulatory News

Laws and government actions (e.g., the US Bitcoin Act, the EU’s MiCA) significantly impact prices. Clarity boosts adoption; bans or restrictions can crash markets.

3. Technology Upgrades or Failures

Prices react to upgrades (e.g., scaling, security) or adverse events (hacks, bugs). Layer-2 solutions and interoperability raise value; technical failures can crush confidence.

4. Macroeconomic Factors

Inflation, interest rates, currency devaluations, and global liquidity affect crypto prices. Bitcoin often rises during inflationary periods as a hedge.

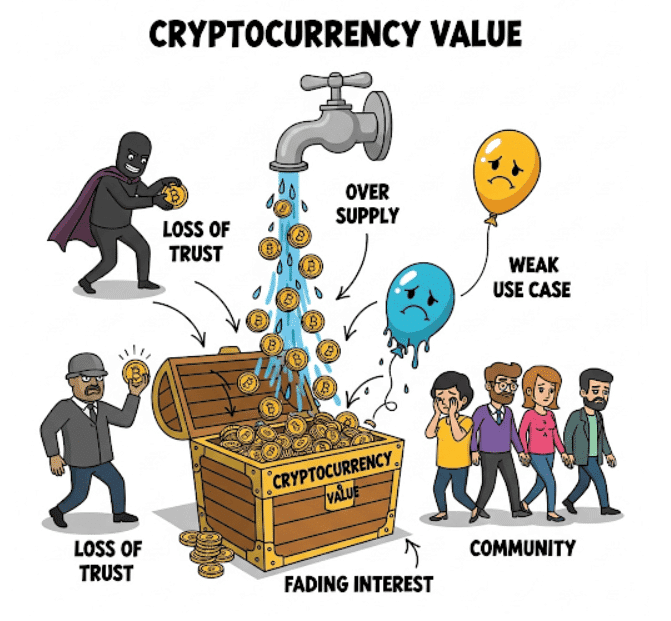

How Does Cryptocurrency Lose Value?

While much attention focuses on cryptocurrency price appreciation, understanding the mechanisms through which cryptocurrencies can lose value is equally important for investors and users. Several key factors can lead to cryptocurrency devaluation, both temporary and permanent.

1. Loss of Trust (Scams, Hacks, Rug Pulls)

Trust is a foundational element of cryptocurrency value, and its erosion often leads to rapid devaluation. Common trust-breaking events include:

- Exchange hacks resulting in stolen customer funds

- Smart contract exploits that drain protocol liquidity

- Fraudulent projects designed to steal investor funds (“rug pulls”)

- Insider trading or market manipulation by project teams

- Technical vulnerabilities that undermine security claims

2. Over-Supply or Dilution (Unlimited Tokens)

The tokenomics of a cryptocurrency, particularly its supply schedule and issuance policy, directly impact its ability to maintain value. Projects with poor supply management face several risks:

- Excessive inflation that outpaces adoption and use case growth

- Unpredictable issuance that creates uncertainty for holders

- Concentrated token distributions that enable price manipulation

- Inadequate token burning mechanisms to offset new issuance

- Governance failures are allowing unplanned supply increases

Cryptocurrencies with unlimited or inflationary supplies often struggle to retain long-term value without growth in utility and adoption. This gives an advantage to those with fixed or deflationary supplies.

3. Weak Use Case or Utility

A cryptocurrency’s value proposition ultimately depends on its utility within an ecosystem. Projects with weak or diminishing utility face substantial devaluation risks:

- Failure to deliver on promised technical capabilities

- Alternative solutions that offer superior performance

- Declining transaction volumes and network usage

- Limited developer interest and ecosystem growth

- Inability to adapt to changing market needs

2025 highlights the necessity of demonstrable utility, as users and investors now evaluate cryptocurrency projects based on actual usage rather than speculation.

4. Community Abandonment or Fork Failures

The social layer of cryptocurrencies, like the users, developers, and stakeholders, is crucial in maintaining value. Factors related to the community that can lead to devaluation include:

- Developer exiting to other promising projects

- Split in communities and resources

- Governance deadlock is preventing necessary protocol upgrades

- Toxic community dynamics that drive away new participants

- Leadership failures or controversial decisions

Community health indicates long-term cryptocurrency viability, with projects featuring strong community engagement and governance showing greater resilience in market downturns.

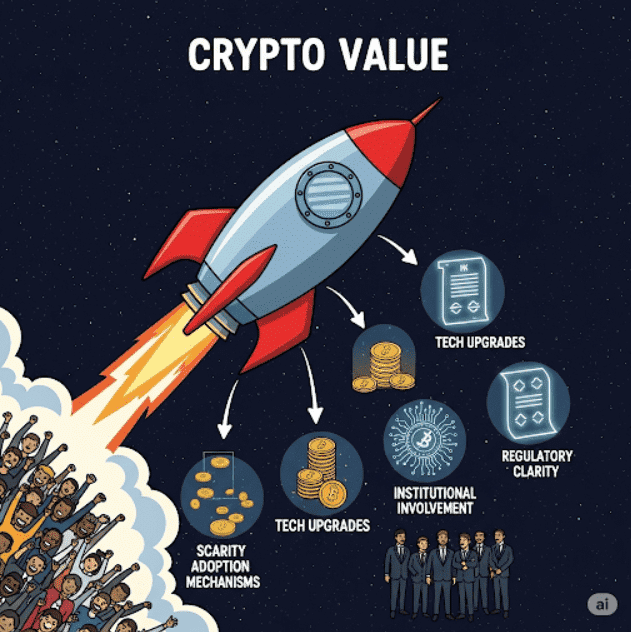

What Increases or Backs Crypto Value?

Understanding the fundamental drivers that support and increase cryptocurrency value helps distinguish between sustainable growth and speculative bubbles. Several key factors contribute to cryptocurrencies’ intrinsic value and price appreciation potential.

How Does Cryptocurrency Have Any Value?

Cryptocurrencies derive value from a combination of technological innovation, network effects, and economic principles. Their fundamental value proposition includes:

- Permissionless access to financial services and value transfer

- Programmable money enabling automated financial operations

- Censorship resistance for transactions and assets

- Verifiable scarcity in digital form

- Reduced counterparty risk through trustless operations

- Global accessibility without geographic restrictions

As usage grows, so does value via the network effect and secure decentralization.

What Is Cryptocurrency Backed By?

Unlike fiat currencies backed by government authority or commodities supported by physical assets, cryptocurrencies are typically backed by a combination of:

- Technological infrastructure: The blockchain and its security mechanisms

- Energy expenditure: Particularly for proof-of-work cryptocurrencies like Bitcoin

- Distributed consensus: Agreement across the network about transaction validity

- Cryptographic guarantees: Mathematical properties ensuring security and scarcity

- Network utility: The practical applications enabled by the cryptocurrency

- Community commitment: The social consensus around the cryptocurrency’s value

This backing shifts from traditional asset backing, creating value through technology, mathematics, and social consensus rather than physical reserves or government decree.

What Increases Crypto Value?

Several reliable drivers consistently increase cryptocurrency value when implemented effectively:

- Rising adoption and utility

- Scarcity mechanisms (like halvings)

- Tech upgrades

- Institutional involvement

- Regulatory clarity

When demand exceeds supply, crypto prices typically rise, resulting in a bull market, where escalating demand, whether from positive sentiment, adoption, or other factors, can surpass the rate at which new crypto tokens are introduced into circulation.

Where Does the Money in Crypto Come From?

The capital flowing into cryptocurrency markets originates from diverse sources, creating both liquidity and price movement:

- Retail investors allocating personal savings to cryptocurrency holdings

- Institutional investors diversifying portfolios with cryptocurrency exposure

- Corporate treasury investments seeking inflation protection or strategic positioning

- Venture capital funding for cryptocurrency infrastructure and applications

- Traders and speculators seeking short-term profit opportunities

- Users requiring cryptocurrencies for practical applications

So basically, Diverse sources add liquidity and long-term stability.

Who Controls the Value of Cryptocurrency?

Unlike centralized financial systems, where value can be directly manipulated by authorities, cryptocurrency value emerges from the collective actions of a diverse ecosystem:

- Miners and validators secure the network and process transactions

- Developers improving protocols and building applications

- Users conducting transactions and utilizing services

- Investors providing capital and liquidity

- Exchanges facilitate trading and price discovery

- Regulators establishing legal frameworks

This control promotes an organic price discovery mechanism where no entity can solely determine value. While large holders can temporarily influence prices with significant transactions, lasting value changes require broader market participation and consensus.

Crypto vs Fiat: What’s the Difference in Value?

Fiat currencies are backed by governments, central banks, and economic productivity. Their value is tied to legal tender status, tax systems, and international trade. In contrast, cryptocurrencies derive value from adoption, utility, scarcity, and global accessibility.

Here is a quick table pointing out the difference between Crypto VS Fiat:

| Aspect | Fiat Currency | Cryptocurrency |

|---|---|---|

| Backed By | Government authority and central banks | Code, cryptography, and decentralized networks |

| Value Source | Legal tender status, taxes, economic strength | Network adoption, utility, scarcity |

| Supply Control | Central banks via monetary policy | Predetermined algorithmic issuance |

| Stability | Generally stable within jurisdictions | Highly volatile |

| Adoption | Universal within issuing country | Voluntary and global |

| Accessibility | Regulated by national boundaries | Borderless, accessible anywhere with internet |

| Security | Institutional protections and legal frameworks | Cryptographic and decentralized security |

| Regulation Risk | Fully regulated and controlled | Subject to evolving regulations |

| Programmability | Limited | Highly programmable (smart contracts, dApps) |

| Inflation Risk | Prone to inflation based on policy | Controlled or deflationary (depends on tokenomics) |

Fiat offers stability and widespread use but is vulnerable to inflation and policy errors. Crypto offers decentralization and programmability but faces volatility and adoption barriers.

Understanding Tokenomics: Why It Matters?

Tokenomics—how a cryptocurrency’s token works—is critical to its long-term value. It includes supply limits, distribution models, token utility, value accrual, governance, and incentives.

Key components of tokenomics include:

- Supply schedule: The rate at which new tokens are created and the total maximum supply

- Distribution model: How tokens are initially allocated and subsequently distributed

- Utility functions: The specific roles the token plays within its ecosystem

- Value capture mechanisms: How the token accrues value from ecosystem growth

- Governance rights: The control token holders have over protocol development

- Incentive alignment: How tokenomics encourages beneficial participant behavior

Understanding these elements helps investors evaluate the fundamental value proposition of any cryptocurrency project beyond short-term price movements or market sentiment.

Effective tokenomics typically feature:

- Sustainable token emission schedules that balance growth needs with value preservation

- Fair initial distributions that prevent excessive concentration

- Clear utility that creates organic demand for the token

- Value accrual mechanisms that benefit long-term holders as the ecosystem grows

- Governance systems that enable adaptation while preventing capture

Successful cryptocurrency projects of 2025 show effective tokenomic design that aligns incentives and ensures sustainable value. In contrast, flawed tokenomics have hindered projects from maintaining value, even with promising technology or strong teams.

How to Know Which Crypto Will Go Up Today?

While long-term cryptocurrency value derives from fundamentals, short-term price movements follow different patterns.

Traders and investors use various indicators to anticipate daily price changes, though with the understanding that cryptocurrency markets remain inherently unpredictable.

Short-term crypto prices are driven by momentum, sentiment, and news, not just fundamentals.

Here are the key indicators of Crypto values going up:

- Volume spikes often precede moves.

- Social sentiment can drive swings.

- On-chain metrics (wallet activity, transactions) reveal real usage.

- News on upgrades, partnerships, or regulations can spark rallies.

Useful tools I use to track my crypto value:

- CoinMarketCap, TradingView: Market data and charting

- LunarCrush, Santiment: Social sentiment

- Glassnode, Nansen: On-chain analytics

- CryptoPanic: News aggregation

Note: Despite advanced tools, markets remain unpredictable. Successful traders focus on risk management and timing, not perfect predictions.

Related Reads:

Conclusion: Cryptocurrency’s Value Stems From Scarcity, Utility, And Demand

Cryptocurrency value stems from a blend of technology, economics, and user adoption. As of 2025, key drivers include fixed supply models, network effects, and blockchain’s utility, enabling secure, programmable, and borderless transactions.

Unlike fiat, many cryptocurrencies offer verifiable scarcity, which underpins long-term value. However, risks like security concerns, regulatory uncertainty, and technical complexity hinder broader adoption.

The market is maturing, with value shifting toward fundamentally strong projects over hype.

Understanding tokenomics, utility, and ecosystem strength is crucial for investors and users to navigate the evolving crypto space with insight beyond daily price volatility.

FAQs

Bitcoin derives value from its scarcity, security, and network effects, not physical backing. Its fixed 21 million supply cap creates digital scarcity that underpins its store of value proposition.

Regulations can impact cryptocurrency prices, but well-designed cryptocurrencies with strong utility and decentralization can adapt to most regulatory environments while preserving their core value propositions.

New cryptocurrencies typically gain initial value through founder credibility, innovative features, clear use cases, fair distribution mechanisms, and community-building efforts that foster early adoption.

Cryptocurrencies have utility value through their functions as transaction networks, programmable money systems, and censorship-resistant stores of value, which constitute their intrinsic value.

Cryptocurrencies will likely coexist with traditional currencies rather than fully replacing them, serving complementary functions in a diverse financial ecosystem with each optimized for different use cases.

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)