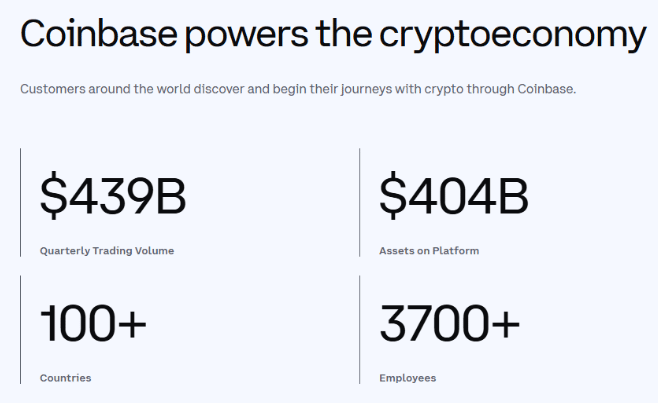

Coinbase processed over $547 billion in crypto trading volume, with approximately 73 million verified users worldwide.

As one of the largest cryptocurrency exchanges, Coinbase operates under specific IRS reporting requirements that affect U.S. taxpayers.

Understanding exactly what Coinbase reports to the IRS—and what it doesn’t—is crucial for compliant tax filing.

With penalties for crypto tax evasion reaching up to $250,000 and potential criminal prosecution, knowing your obligations and Coinbase’s reporting practices has never been more critical.

So, let’s get into it!

TLDR: Does Coinbase Report to IRS in 2025?

Coinbase has limited reporting obligations to the IRS that vary by transaction type.

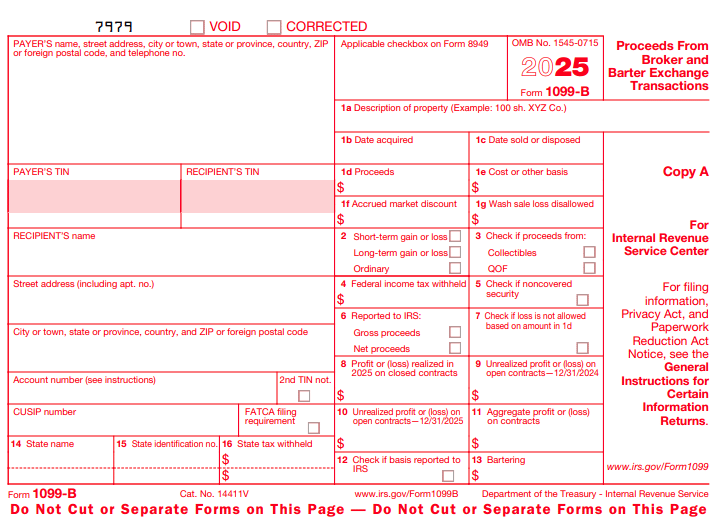

For 2025 tax filings (covering 2024 activity), Coinbase provides Form 1099-MISC to users who earned over $600 in staking rewards or other crypto income. For Futures trading, it issues Form 1099-B for cost basis and proceeds.

However, Coinbase does not report regular crypto sales, conversions, or spending to the IRS. The taxpayer is solely responsible for reporting all taxable crypto transactions, regardless of Coinbase’s reporting.

Understanding Coinbase’s IRS Reporting Requirements

Coinbase’s legal obligation to report to the IRS is more limited than many users assume. Currently, Coinbase must report certain types of crypto income to the IRS, but not all transaction types trigger reporting requirements.

For income-generating activities like staking and rewards, Coinbase must issue Form 1099-MISC to both the recipient and the IRS when these earnings exceed $600 annually.

For Futures trading through Coinbase Finance Markets, the exchange reports cost basis, proceeds, and gains or losses on Form 1099-B.

From 2017-2020, Coinbase issued Form 1099-K to users who exceeded $20,000 in trading volume and 200 transactions. In 2021, Coinbase discontinued issuing 1099-K forms, creating a reporting gap until the current framework was established. This change reflected uncertainty in regulatory guidance for cryptocurrency exchanges.

Despite these limited reporting requirements, the IRS considers all crypto transactions taxable events. This creates a disconnect between what Coinbase reports and what taxpayers are legally obligated to report.

What Amount Does Coinbase Report to the IRS?

The reporting thresholds that trigger Coinbase’s IRS reporting vary by activity type.

For staking rewards, crypto interest, and other income, Coinbase reports amounts exceeding $600 annually through Form 1099-MISC. This $600 threshold applies to the cumulative total of all rewards earned throughout the tax year.

For Futures trading, all transactions are reported on Form 1099-B regardless of the amount. This form details cost basis, proceeds, and realized gains or losses.

Notably, Coinbase does not report standard crypto buying, selling, or trading to the IRS, regardless of the transaction amount. This means that even if you sold $1 million worth of Bitcoin on Coinbase, the exchange itself would not report this transaction directly to the IRS.

Different activity types receive different tax treatment.

Income from staking, rewards, and interest is taxed as ordinary income at your regular income tax rate. Capital gains from selling or trading crypto are taxed at either:

- Short-term rates (for assets held less than a year)

- Preferential long-term rates (for assets held longer than a year).

Coinbase Tax Documents

Coinbase provides several types of tax documents to help users meet their reporting obligations. These include official IRS forms (when applicable) and Coinbase-generated reports.

The official IRS forms you may receive include:

- Form 1099-MISC: For users earning over $600 in staking, rewards, or promotional bonuses.

- Form 1099-B: For users trading Futures through Coinbase Finance Markets.

Coinbase also provides supplementary documents that, while not filed with the IRS, help users prepare their tax returns:

- Gain/Loss Report: A comprehensive summary of all taxable events on Coinbase, including sales, trades, and conversions.

- Raw Transaction Report: A detailed log of all transactions without calculated gains/losses.

Your Coinbase tax documents for the previous tax year are typically available by late January. If you don’t see your documents, they may not have been generated yet, or you may not have met the reporting thresholds for official forms.

Does Coinbase Issue 1099-B?

Coinbase issues Form 1099-B exclusively for users who trade Futures through Coinbase Finance Markets. This form is not issued for regular cryptocurrency buying, selling, or trading on the main Coinbase platform.

The 1099-B contains critical information for tax reporting, including:

- Description of the property (the specific futures contracts traded)

- Date acquired and date sold

- Proceeds from sales

- Cost basis (what you paid for the assets)

- Realized gain or loss

- Whether gains are short-term or long-term

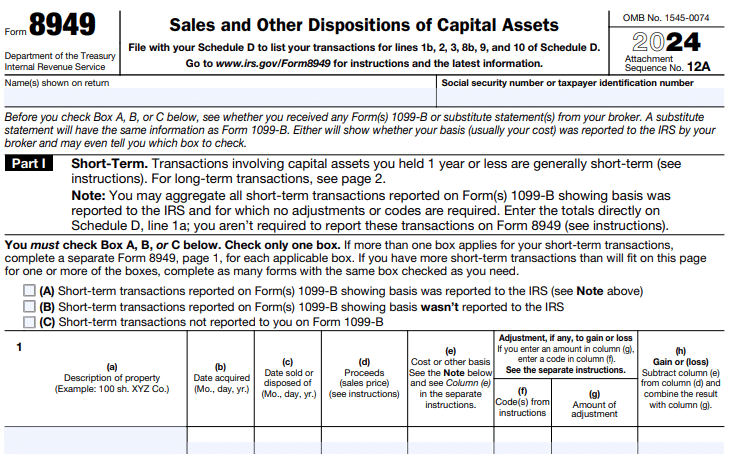

When you receive a 1099-B from Coinbase, you’ll use this information to complete Form 8949 and Schedule D of your tax return.

The form simplifies tax reporting for Futures trading since it provides calculated cost basis and gain/loss information. However, you should still verify the accuracy of this information against your own records.

Even if you don’t receive a 1099-B from Coinbase for your regular crypto trading, you’re still legally obligated to report all taxable events on your tax return.

Coinbase 1099-MISC Form

Coinbase issues Form 1099-MISC to users who earned over $600 in crypto income through activities like staking, rewards programs, or Coinbase Learn campaigns. This form reports “miscellaneous income” that is taxable at ordinary income rates.

Activities that generate 1099-MISC reporting include:

- Staking rewards from proof-of-stake cryptocurrencies

- Interest earned from lending protocols

- Promotional rewards and airdrops

- Education rewards (like Coinbase Learn)

- Referral bonuses

The 1099-MISC shows the fair market value of the crypto at the time it was received. This value becomes your cost basis for that crypto if you later sell or trade it.

To report 1099-MISC income on your tax return, include the amount shown on Box 3 of your 1099-MISC on Schedule 1 of Form 1040 as “Other Income.” You’ll then transfer the total from Schedule 1 to your Form 1040.

Even if you don’t receive a 1099-MISC because your crypto income was below $600, you’re still legally required to report all crypto income on your tax return. The $600 threshold only determines Coinbase’s reporting obligation, not your tax liability.

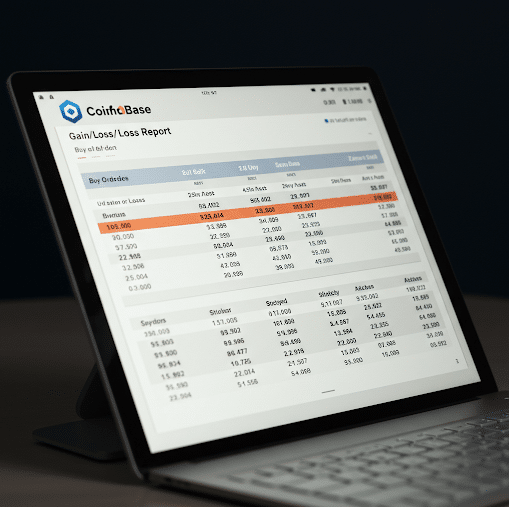

Coinbase Gain/Loss Report

The Coinbase Gain/Loss Report is a valuable tool for tax preparation, though it’s not an official IRS form. This report consolidates all your taxable events on Coinbase throughout the year and calculates the resulting capital gains or losses.

To effectively use this report for tax filing:

- Download the report from Coinbase Tax Center.

- Review the calculated gains and losses for accuracy.

- Transfer the information to Form 8949, categorizing transactions as short-term or long-term.

- Summarize the totals on Schedule D of your tax return.

The Gain/Loss Report has important limitations to be aware of the following:

- It only includes transactions made on Coinbase’s leading platform, not Coinbase Wallet or Coinbase Pro transactions.

- It also can’t account for crypto acquired outside Coinbase, potentially leading to incorrect cost basis calculations.

You’ll need additional documentation beyond the Gain/Loss Report if you:

- Used multiple exchanges or wallets

- Participated in DeFi protocols

- Made peer-to-peer transactions

- Received crypto as payment for goods or services

- Engaged in mining activities

In these cases, consider using specialized crypto tax software that can aggregate data from multiple sources and produce comprehensive tax reports.

Your Tax Obligations Beyond Coinbase Reporting

Regardless of what Coinbase reports to the IRS, taxpayers bear responsibility for reporting all crypto transactions.

The IRS treats cryptocurrency as property, meaning every sale, trade, conversion, or use as payment constitutes a taxable event requiring reporting.

Even transactions that Coinbase doesn’t report to the IRS must still appear on your tax return. This includes:

- Crypto-to-crypto trades (e.g., Bitcoin to Ethereum)

- Selling crypto for fiat currency

- Using crypto to purchase goods or services

- Converting crypto to stablecoins

- Gifting crypto over certain thresholds

Maintain detailed records for transactions across multiple platforms, including dates, amounts, values in USD at the time of transaction, and purpose.

Consider using specialized crypto tax software like CoinTracker, Koinly, or TaxBit, which can import data from multiple exchanges and generate consolidated tax reports.

The IRS has increased enforcement efforts around cryptocurrency compliance, including adding a dedicated cryptocurrency question on Form 1040. Willful non-compliance can result in penalties of up to $250,000, potential criminal prosecution, and interest on unpaid taxes.

How to Properly File Taxes with Coinbase?

Filing taxes for your Coinbase activity requires several specific steps:

1. Gather all necessary documents from Coinbase:

- Any 1099 forms issued by Coinbase

- Gain/Loss Report

- Raw Transaction Report

2. Complete Form 8949 for capital gains/losses:

- List each crypto sale or disposal separately

- Include description, date acquired, date sold, proceeds, cost basis, and gain/loss

- Check Box A for short-term transactions or Box D for long-term transactions

3. Summarize all 8949 entries on Schedule D:

- Transfer short-term totals to Part I

- Transfer long-term totals to Part II

- Calculate net capital gain or loss

4. Report crypto income on Schedule 1:

- Include staking, rewards, and other crypto income in Line 8 (“Other income”)

- Attach this schedule to your Form 1040

5. Answer the cryptocurrency question on Form 1040:

- The form asks whether you received, sold, or exchanged cryptocurrency

- Answer accurately based on your activity

Best practices for Coinbase tax reporting include keeping contemporaneous records of all transactions, maintaining consistent cost basis calculation methods (FIFO, LIFO, or specific identification), and reconciling Coinbase reports with your actual transaction history to ensure accuracy.

If your situation is complex or involves large sums, consider working with a tax professional familiar with cryptocurrency as crypto tax regulations continue to evolve.

Related Reads:

Conclusion: Coinbase Reports Limited Income; Users Report All Taxes

Coinbase only reports certain activities to the IRS—primarily income over $600 through 1099-MISC and Futures trading via 1099-B—taxpayers remain responsible for reporting all taxable crypto events.

With the IRS intensifying enforcement and penalties reaching up to $250,000 for non-compliance, maintaining comprehensive records and accurately reporting all transactions is crucial.

As regulatory frameworks evolve, staying informed about changing requirements and potentially seeking professional assistance will help ensure compliance and minimize tax liability in this complex and rapidly changing landscape.

FAQs

The IRS cannot access your Coinbase account directly. However, through legal means like the John Doe summons, it has obtained user information from high-volume accounts. Also, information Coinbase reports via 1099 forms is visible to tax authorities.

Coinbase will send a 1099-MISC if you earned over $600 in staking, rewards, or other crypto income in 2024. If you traded Futures through Coinbase Finance Markets, you’ll receive a 1099-B. Most regular crypto trading activities do not trigger 1099 issuance from Coinbase.

Non-custodial wallets like Coinbase Wallet, MetaMask, Ledger, or Trezor do not report to the IRS since they don’t hold your crypto or have visibility into your complete financial picture. However, you’re still legally obligated to report all taxable transactions made through these wallets.

The absence of a 1099 from Coinbase does not exempt you from tax obligations. All taxable crypto events must be reported regardless of whether Coinbase issues tax forms. Your activity determines your tax liability, not what Coinbase reports to the IRS.

Coinbase does not report simple buying and holding of cryptocurrency to the IRS. Coinbase has reporting obligations only when you earn income (over $600) through staking/rewards or trade Futures. However, you must report when you eventually sell or trade those assets.

Coinbase Wallet, a non-custodial wallet where you control your private keys, does not report any transactions to the IRS. This differs from the Coinbase exchange, which reports certain activities described above. Your personal reporting obligations remain the same for both platforms.

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)