Remember when FTX collapsed in 2022? That was a wake-up call for crypto traders everywhere. Suddenly, everyone realized that trusting a centralized exchange with their money wasn’t the safest bet. That’s when decentralized exchanges (DEXs) really started to shine.

Fast forward to 2025, and DEXs are handling billions in daily trades. They’ve gone from being a niche option to processing over 15% of all crypto transactions worldwide. And it’s not hard to see why.

Think about it: with a DEX, you control your own money. No more worrying about exchanges freezing your funds or getting hacked. No more submitting countless documents just to trade. You simply connect your wallet and start trading.

That’s why I got you the top 12 decentralized crypto exchanges on which you can consider investing.

What is A Decentralized Crypto Exchange?

Let’s break it down in simple terms. A decentralized exchange is like a digital marketplace where you can trade cryptocurrencies directly with other people. No middleman. No bank. No company holding your money.

Here’s how it’s different from regular exchanges like Coinbase or Binance:

- You keep your crypto in your own wallet

- You don’t need to create an account or verify your identity

- Smart contracts handle the trades automatically

- Everything happens on the blockchain

The magic happens through something called Automated Market Makers (AMMs). Don’t let the fancy name fool you – it’s just a smart contract that sets prices based on supply and demand. When you want to trade, the AMM finds you the best price automatically.

The best part? You’re always in control. Your money stays in your wallet until the exact moment of the trade. No more trusting exchanges to keep your funds safe. No more worrying about hacks or frozen accounts.

Top 12 Decentralized Crypto Exchanges in 2025

Ready to dive into the world of DEXs? Here are the top platforms making waves in 2025. Each one brings something unique to the table, whether you’re a beginner or a seasoned trader.

| Exchange | Blockchain | Daily Volume | Total Value Locked | Token |

|---|---|---|---|---|

| Uniswap | Ethereum, Polygon, Arbitrum | $1.4B | $3.7B | UNI |

| dYdX | StarkEx Layer 2 | $1.13B | $500M | DYDX |

| PancakeSwap | BNB Chain | $900B | $2.1B | CAKE |

| 1inch | Multi-chain | $850M | $400M | 1INCH |

| Curve Finance | Ethereum, Polygon | $800M | $2B+ | CRV |

| Balancer | Ethereum | $600M | $1.5B | BAL |

| SushiSwap | Multi-chain | $500M | $300M | SUSHI |

| Orca | Solana | $450M | $250M | ORCA |

| Vertex | Arbitrum | $400M | $200M | VRTX |

| Kyberswap | Multi-chain | $350M | $150M | KNC |

| Camelot | Arbitrum | $300M | $180M | GRAIL |

| Jupiter | Solana | $550M | $300M | JUP |

1. Uniswap

Uniswap is the granddaddy of modern DEXs. They invented the AMM model that everyone else copied, and they’re still the biggest player in the game with $1.4 billion in daily trades.

What makes Uniswap special is their V3 upgrade. It lets liquidity providers focus their funds on specific price ranges, making their money work harder. Plus, with expansions to multiple blockchains, you’re not stuck with Ethereum’s high gas fees anymore.

Key Features:

- Created the AMM model

- Works on multiple blockchains

- Over 10,000 tokens available

- Community governance with UNI token

- Concentrated liquidity for better returns

Native Token Price: UNI – around $5.27

2. dYdX

If you’re into serious trading, dYdX is your playground. This isn’t your basic swap platform – it’s built for traders who want leverage, perpetual contracts, and all the bells and whistles.

The coolest part? Zero gas fees. They use StarkWare’s Layer 2 tech to make trades lightning fast and completely free. With $1.13 billion in daily volume, it’s clear that pro traders have found their home.

Key Features:

- Zero gas fees

- Up to 20x leverage

- Perpetual contracts

- Pro-level trading tools

- Order books like centralized exchanges

Native Token Price: DYDX – around $0.65

3. PancakeSwap

PancakeSwap is like Uniswap’s fun cousin on BNB Chain. It’s fast, cheap, and perfect for beginners. While Ethereum users groan about gas fees, PancakeSwap users are trading for pennies.

Beyond basic swaps, PancakeSwap has built an entire ecosystem. You can farm yields, stake tokens, trade NFTs, and even play the lottery. It’s become the go-to DEX for anyone tired of Ethereum’s high costs.

Key Features:

- Ultra-cheap transactions

- Yield farming paradise

- NFT marketplace

- Fun lottery system

- Beginner-friendly interface

Native Token Price: CAKE – around $2.02

4. 1inch Exchange

1inch is like having a personal shopping assistant for crypto. Instead of checking prices on different exchanges, 1inch does it all for you. It searches over 200 sources to find you the best deal.

The best part? No extra fees. You only pay the network gas costs. Their smart routing can even split your order across multiple exchanges to get you the absolute best price.

Key Features:

- Searches 200+ liquidity sources

- No platform fees

- Smart order splitting

- Works on multiple blockchains

- Gas optimization

Native Token Price: 1INCH – around $0.21

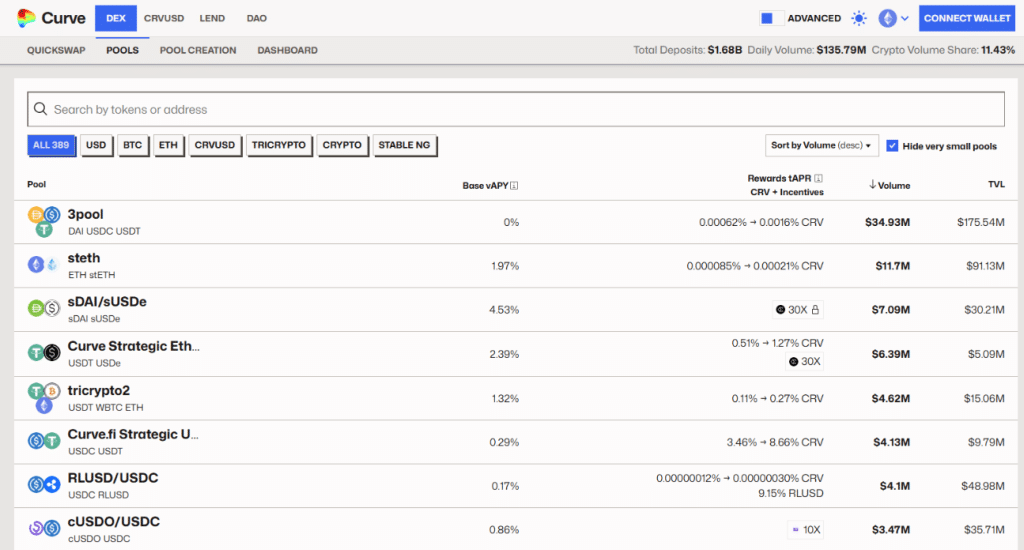

5. Curve Finance

Curve is the master of stablecoin swaps. With over $2 billion locked in the platform, it’s where big players go when they need to swap large amounts without moving the price.

Their secret sauce is a special algorithm designed for assets that should have similar values (like different stablecoins). This means you can swap millions of dollars worth of USDC to USDT with minimal slippage.

Key Features:

- Best for stablecoin trading

- Minimal slippage on big trades

- $2B+ in total value locked

- Works on multiple chains

- Boosted rewards for long-term stakers

Native Token Price: CRV – around $0.72

6. Balancer

Balancer takes a different approach. Instead of simple trading pairs, you can create pools with up to eight different tokens in custom ratios. It’s like building your own index fund that earns trading fees.

This flexibility makes Balancer perfect for portfolio management. The pools automatically rebalance based on trades, keeping your desired ratios while earning fees from traders.

Key Features:

- Custom multi-token pools

- Automatic portfolio rebalancing

- Flexible pool weights

- Layer 2 support

- Smart pool technology

Native Token Price: BAL – around $1.19

7. SushiSwap

SushiSwap started as a Uniswap clone but has grown into something completely different. Now operating on 14 blockchains, it’s become a full DeFi ecosystem with trading, lending, and borrowing.

What sets Sushi apart is its community focus. SUSHI holders get a share of all trading fees, creating a real sense of ownership. The platform keeps innovating with new features voted on by the community.

Key Features:

- Available on 14 blockchains

- Revenue sharing for holders

- Complete DeFi suite

- Strong community governance

- Kashi lending platform

Native Token Price: SUSHI – around $0.68

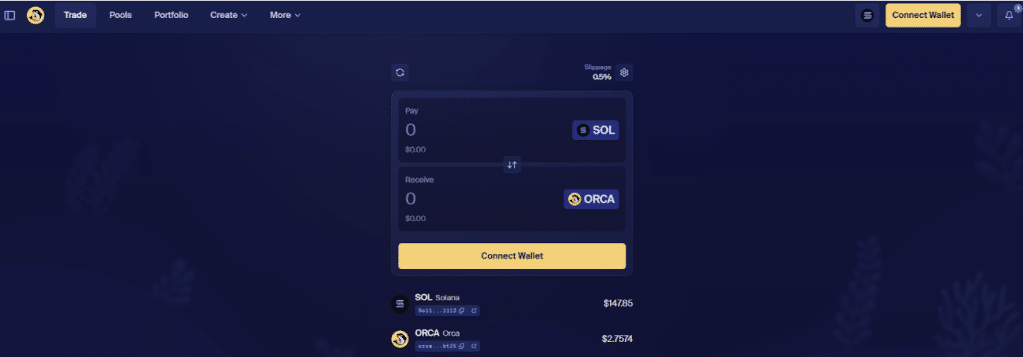

8. Orca

Orca brings DEX trading to Solana, where transactions are nearly instant and cost less than a penny. Their Fair Price Indicator is brilliant – it warns you if you’re about to make a bad trade.

The interface is refreshingly simple. No confusing charts or complex settings. Just clean, straightforward trading that even your grandma could figure out. It’s proof that DeFi doesn’t have to be complicated.

Key Features:

- Fair Price Indicator

- Lightning-fast Solana trades

- Super low fees

- Clean, simple interface

- Concentrated liquidity pools

Native Token Price: ORCA – around $2.77

9. Vertex

Vertex has an interesting backstory. When Terra blockchain collapsed, they didn’t give up. They moved everything to Arbitrum and came back stronger. Now they offer cross-margin trading that lets you use one account for everything.

Their hybrid system combines the best of both worlds: off-chain order matching for speed, on-chain settlement for security. Plus, you can bridge assets from eight different blockchains.

Key Features:

- Cross-margin trading

- 8-chain bridge support

- Professional trading tools

- Hybrid order book

- Institutional-grade features

Native Token Price: VRTX – around $0.04

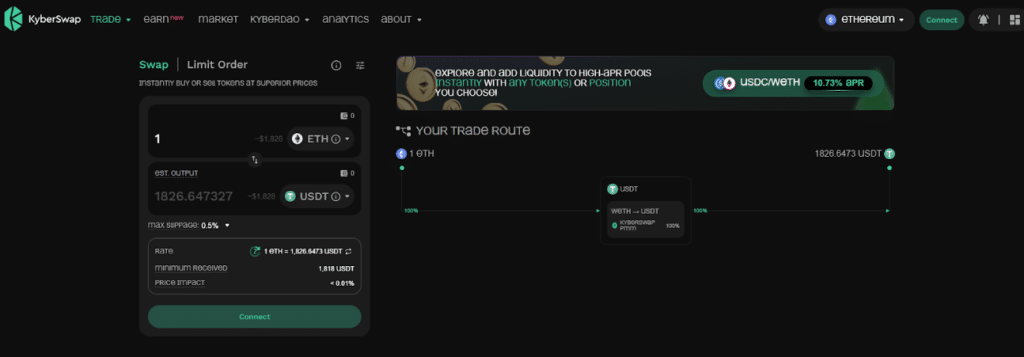

10. Kyberswap

Kyberswap is all about efficiency. Their dynamic fee system adjusts based on market conditions, and their elastic pools maximize returns for liquidity providers.

Supporting over 12 blockchains, Kyberswap helps you find the best prices across their own pools and other DEXs. It’s smart trading for people who want to squeeze out every bit of value.

Key Features:

- Dynamic fee adjustment

- Elastic liquidity pools

- 12+ blockchain support

- Smart routing

- Capital efficiency focus

Native Token Price: KNC – around $0.37

11. Camelot

Camelot is Arbitrum’s homegrown DEX with a mission: support new projects in the ecosystem. Their launchpad has helped numerous projects raise funds and find their footing.

What’s unique is their dual reward system. Liquidity providers earn both trading fees and extra tokens, making it attractive for long-term participants. It’s community building at its finest.

Key Features:

- Native to Arbitrum

- Project launchpad

- Dual reward system

- Scalable architecture

- Community-focused

Native Token Price: GRAIL – around $359.71

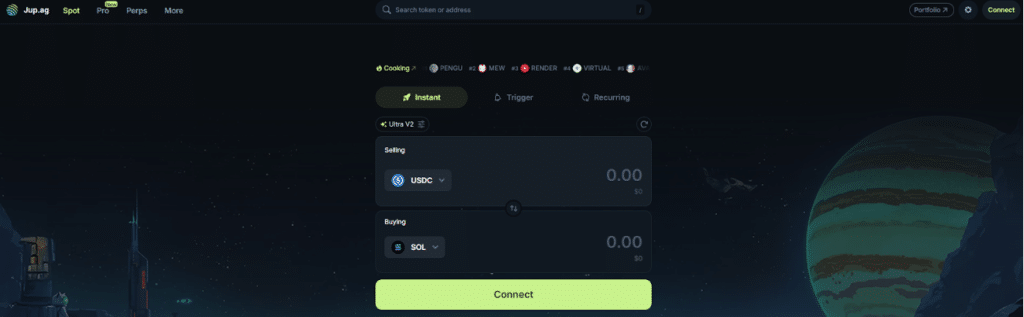

12. Jupiter Aggregator

Jupiter is Solana’s answer to 1inch. It searches all Solana DEXs to find you the best prices, handling over $550 million in daily volume. But it’s not just about price – Jupiter considers fees, slippage, and route complexity too.

They’ve recently added limit orders and DCA (dollar-cost averaging) features, making it more than just an aggregator. It’s becoming a complete trading platform on Solana.

Key Features:

- Solana DEX aggregation

- Smart routing algorithms

- Limit orders

- DCA trading

- Perpetual trading (beta)

Native Token Price: JUP – around $0.45

Why Invest in Decentralized Crypto Exchanges?

Let’s talk about why DEXs are worth your attention. It’s not just about trading – it’s about being part of a financial revolution.

You’re in Control

With DEXs, your crypto stays in your wallet. Period. No more lying awake wondering if your exchange will get hacked or freeze your funds. You control your private keys, which means you control your money.

Privacy Matters

Tired of submitting your ID, proof of address, and your firstborn’s birth certificate just to trade? DEXs let you trade without all that hassle. Connect your wallet and go. It’s that simple.

See Everything

Every trade on a DEX is recorded on the blockchain. You can see exactly what’s happening, when it’s happening, and how it works. No more black boxes or “trust us” promises from exchanges.

Make Money While You Sleep

DEXs introduced amazing ways to earn passive income:

- Provide liquidity and earn trading fees

- Stake tokens for rewards

- Participate in yield farming

- Vote on protocol changes that increase value

Can’t Be Shut Down

Remember when certain countries banned crypto exchanges? DEXs don’t care. They run on decentralized networks that can’t be censored or shut down by any single entity.

Lower Fees

Without offices, compliance teams, and customer service departments, DEXs have way lower overhead. This means lower fees for you and better returns on your investments.

Growing Fast

The numbers don’t lie. DEX trading volume keeps growing year after year. As more people discover the benefits, this trend is only going to accelerate.

Related Reads:

Conclusion: Uniswap is the leading decentralized crypto exchange in the market

Decentralized exchanges have come a long way from their clunky beginnings. Today’s DEXs are fast, efficient, and packed with features that make trading easier and more profitable than ever.

Whether you’re drawn to Uniswap’s massive liquidity, dYdX’s professional tools, or PancakeSwap’s low fees, there’s a DEX that fits your needs. These platforms aren’t just alternatives to centralized exchanges – they’re building something entirely new.

The beauty of DEXs is that they put power back in your hands. Your money, your control, your decisions. No middlemen, no gatekeepers, no asking permission.

The future of finance is being built right now, trade by trade, on these decentralized platforms. And the best part? Anyone can participate. All you need is a wallet and an internet connection.

![Crypto Tax Free Countries In 2025 [Updated List]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Crypto-Tax-Free-Countries-1-1024x536.png)

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)