The global cryptocurrency market has achieved a remarkable milestone in 2025, reaching a total market capitalization of $3.46 trillion as of May 2025, marking a significant 45.47% year-over-year increase.

This astronomical valuation—larger than the GDP of many developed nations—represents the culmination of over a decade of growth, innovation, and increasing mainstream adoption since Bitcoin’s introduction in 2009.

The market now encompasses over 16,497 distinct cryptocurrencies traded across 1,268 exchanges worldwide, creating a diverse digital asset ecosystem that extends far beyond its original premise of peer-to-peer electronic cash.

Despite periodic volatility and regulatory challenges across multiple jurisdictions, the cryptocurrency market has demonstrated remarkable resilience, with Bitcoin maintaining its position as the dominant cryptocurrency with a market capitalization of $2.07 trillion, representing 59.7% of the total market.

Key Highlights

- The global cryptocurrency market is valued at $3.46 trillion as of May 2025

- Bitcoin maintains a dominant market position with a 59.7% market share

- Uniswap is the biggest decentralized crypto exchange, with a $4.15 billion

- Over 16,497 cryptocurrencies are tracked across 1,268 exchanges worldwide

- Market projected to grow at a CAGR of 13.1% from 2025 to 2030

- Stablecoins represent 7.11% of total market capitalization at $246 billion

- The United States leads with a projected revenue of $9.4 billion in 2025

Source: CoinGecko, CoinMarketCap

Cryptocurrency Market Overview

The cryptocurrency market continues its remarkable trajectory in 2025, reaching a total market capitalization of $3.46 trillion, representing a 45.47% increase compared to 2024. This significant growth comes despite regulatory challenges across multiple jurisdictions and periodic market volatility.

With over 16,497 cryptocurrencies tracked across 1,268 exchanges, the market has evolved substantially from its humble beginnings with Bitcoin in 2009. Today’s cryptocurrency ecosystem encompasses various asset types, including payment tokens, utility tokens, security tokens, stablecoins, and decentralized finance (DeFi) applications.

Source: CoinGecko, Forbes

Current Cryptocurrency Market Size & Distribution

The cryptocurrency market is positioned for continued robust growth through the coming decade, with major research firms projecting significant expansion.

- The market is expected to grow at a compound annual growth rate (CAGR) of 13.1% from 2025 to 2030, potentially reaching $11.71 billion by the end of the forecast period. (Source: Grand View Research)

- Bitcoin maintains its position as the dominant cryptocurrency, with a market capitalization of $2.07 trillion, representing 59.7% of the total market.

- Ethereum, the second-largest cryptocurrency, holds 8.77% of market share. Stablecoins have emerged as a significant segment, with a combined market capitalization of $246 billion (7.11% of the total crypto market). These price-stable cryptocurrencies provide essential liquidity and trading pairs across the ecosystem.

- The market’s total user base is expected to reach 861.01 million by the end of 2025, with a global user penetration rate of 11.02% (Source: DemandSage).

The projected growth is supported by multiple factors, including increasing adoption as an investment asset class, expanding use cases through decentralized finance applications, and growing acceptance as a payment method by mainstream businesses and financial institutions.

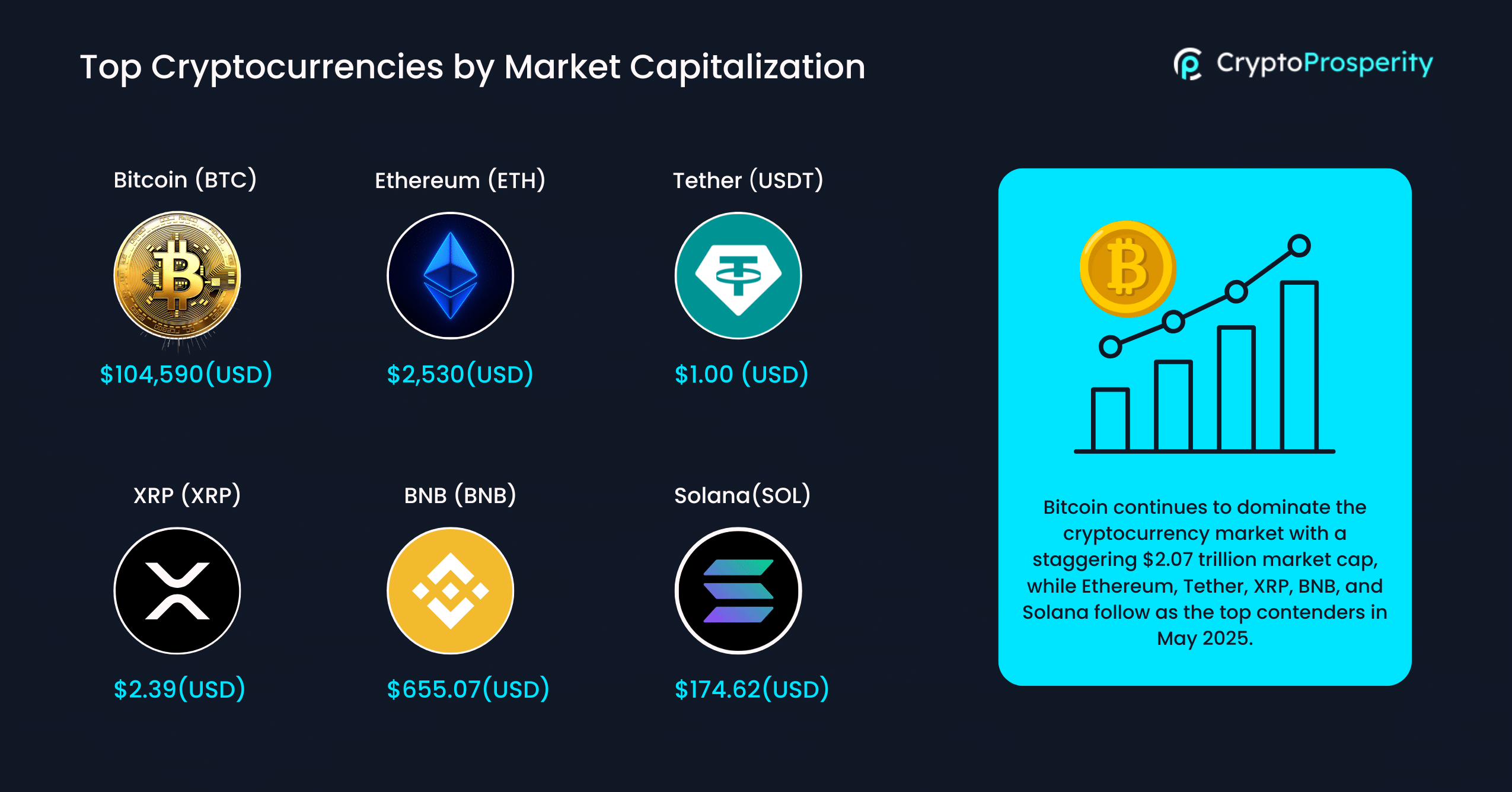

Top Cryptocurrencies by Market Capitalization

The cryptocurrency market’s composition reflects a mix of established players and emerging contenders, with Bitcoin maintaining its dominant position since its inception. As of May 2025, the market leaders by capitalization are:

| Rank | Cryptocurrency | Symbol | Price (USD) | Market Cap (USD) | 24h Change |

|---|---|---|---|---|---|

| 1 | Bitcoin | BTC | $104,590 | $2.07 trillion | -0.10% |

| 2 | Ethereum | ETH | $2,530 | $301.83 billion | -1.20% |

| 3 | Tether | USDT | $1.00 | $150.00 billion | 0.00% |

| 4 | XRP | XRP | $2.39 | $139.70 billion | -0.41% |

| 5 | BNB | BNB | $655.07 | $95.43 billion | -1.61% |

| 6 | Solana | SOL | $174.62 | $90.55 billion | -0.79% |

Source: CoinGecko, May 2025

Notable in this distribution is Bitcoin’s overwhelming market dominance at 59.7%, significantly higher than all other cryptocurrencies combined.

This represents a shift from previous years when Bitcoin’s dominance had fallen below 50%, suggesting a potential consolidation of market value in the primary cryptocurrency as institutional adoption has increased (CoinGecko, 2025).

Global Cryptocurrency Regional Market Analysis

- The United States leads cryptocurrency adoption among developed economies, with projected revenue of $9.4 billion in 2025 and approximately 40% of Americans now owning cryptocurrency, a significant increase from 30% in 2023.

- Developing economies show particularly high adoption rates, with India maintaining the highest global crypto adoption rate at 29%, followed by Nigeria (27%), Vietnam (25%), and Australia (22%).

- The North American cryptocurrency market held a significant share in 2024, supported by the presence and concentration of prominent cryptocurrency mining operations such as Riot Blockchain, Marathon Digital, and Bitfarm.

- In Europe, the progressive regulatory landscape, particularly the European Union’s comprehensive Markets in Crypto-Assets Regulation (MiCA), has created a favorable environment for cryptocurrency businesses and contributed to market growth.

Source: BuyBitcoinWorldwide, GrandViewResearch

Primary Cryptocurrency Market Drivers

- The entrance of major financial institutions and corporations has significantly impacted market growth. In November 2024, cryptocurrency reached a milestone when its total market capitalization hit $3.2 trillion, driven largely by institutional investment (Grand View Research, 2025).

- Major companies like MasterCard have expanded services to allow network partners to enable customers to buy, trade, and hold digital currencies, contributing to broader adoption (Grand View Research, 2025).

Blockchain Technology Advancement and Infrastructure Development

- Improvements in blockchain technology, particularly in scalability, interoperability, and energy efficiency, have addressed previous limitations that constrained market growth. The transition of Ethereum to proof-of-stake and the emergence of faster Layer-1 networks have expanded the market’s capabilities.

- For instance, in November 2024, VanEck launched a new exchange-traded note (ETN) focused on the Sui blockchain, expanding access to decentralized finance (DeFi) investments for European investors (Grand View Research, 2025).

Integration with Traditional Payment Systems and E-commerce

- In November 2024, Ingenico and Crypto.com announced a partnership enabling merchants to accept crypto payments while settling in traditional currencies, reducing volatility risks (Grand View Research, 2025).

- This “plug-and-play” system allows merchants to seamlessly accept crypto payments while ensuring funds are settled in local currencies such as GBP, EUR, AUD, and USD (Grand View Research, 2025).

Regulatory Development and Institutional Frameworks

- The European Union’s Markets in Crypto-Assets (MiCA) law has created a standardized legal framework for the crypto asset market across member countries (Fortune Business Insights, 2025).

- In February 2022, the Indian government moved toward legalizing cryptocurrency by announcing a 30% tax on income generated by the transfer of digital currencies, signaling growing acceptance even in previously restrictive jurisdictions (Grand View Research, 2025).

Market Challenges of Cryptocurrencies

- Cryptocurrencies remain banned in 51 countries as of 2025, and inconsistent regulatory approaches across jurisdictions create compliance challenges for global operators.

- Cryptocurrency-related fraud accounted for $2.57 billion in losses in 2022, representing approximately one-third of total investment fraud that year.

- Over 46,000 people reported losing more than $1 billion in crypto between January 2021 and June 2022, according to the U.S. Federal Trade Commission.

- As market value increases, security threats continue to evolve, with 120 different crypto fraud incidents recorded in 2022 alone—a 28% rise from the previous year.

- Although many networks have transitioned to more efficient consensus mechanisms, concerns about energy consumption persist, particularly for Bitcoin mining operations. Bitcoin mining has a total capital of $8.11 billion, with miners generating daily revenue of $27.70 million. The environmental impact of this energy consumption has led to restrictions on mining operations in some jurisdictions and remains a point of criticism for the industry.

Cryptocurrency Future Market Outlook (2025-2030)

The cryptocurrency market is expected to continue its robust growth through 2030, driven by several emerging trends that are reshaping the digital asset landscape:

- Central banks worldwide are increasingly exploring or implementing digital versions of national currencies. The Bank of Thailand, Central Bank of Uruguay, Eastern Caribbean Central Bank, and People’s Bank of China all support CBDC initiatives for adopting digital cash as an exchange medium.

- The DeFi sector continues to grow, offering blockchain-based alternatives to traditional financial services including lending, borrowing, trading, and asset management.

- In Singapore, for example, Coinbase launched an Engineering Hub in partnership with the Singapore Economic Development Board to enhance the local developer ecosystem and support blockchain innovation beyond just cryptocurrencies.

Suggested Reads:

Conclusion: The Evolving Role of Cryptocurrencies in the Global Financial Landscape

The cryptocurrency market has evolved from a niche technological experiment to a substantial financial ecosystem valued at $3.46 trillion in 2025. With Bitcoin maintaining its dominant position and institutional adoption accelerating, the market is projected to continue its growth trajectory through 2030.

While challenges remain, particularly in regulatory harmony and security, technological advancements and increasing mainstream acceptance suggest a maturing market with expanding real-world applications.

For investors, businesses, and policymakers, understanding the dynamics of this rapidly evolving sector will be crucial in navigating the digital asset landscape of the future.