Cryptocurrency burning permanently removes tokens from circulation, reducing the total supply. This deliberate act creates scarcity in the market, which can increase the value of remaining tokens and serve as a key economic strategy in digital asset management.

This article explains crypto burning, why projects implement it, and how it impacts the cryptocurrency ecosystem.

We’ll cover the technical process of burning tokens, explore different mechanisms, and review real-world examples. We will also discuss the benefits and drawbacks of this growing practice in cryptocurrency.

Crypto Burning – Key Takeaways

Cryptocurrency burning permanently removes tokens from circulation, reducing the number of coins available in the market. Here are some key takeaways:

- Tokens are permanently sent to inaccessible wallet addresses.

- Supply reduction creates scarcity, potentially increasing token value.

- Burns are transparent and verifiable on public blockchains.

- Burning helps control inflation and support token prices.

Understanding Cryptocurrency Burning

Burning crypto means permanently removing tokens from circulation. This is typically done by transferring the tokens to a burn address, a wallet from which they can never be retrieved.

Think of it like sending money into a locked vault where the key has been destroyed.

Once tokens enter this address, they are effectively removed from the market forever, reducing the total supply of that cryptocurrency.

When tokens are burned, they aren’t just “deleted” in the traditional sense—they’re sent to specialized addresses that can only receive tokens and never send them out.

These specialized addresses, often called “eater” or “null” addresses, have no known private keys, making the tokens sent there permanently inaccessible.

The Mechanics of Burning Cryptocurrency

The mechanics of burning cryptocurrency involve a step-by-step process to permanently remove tokens from circulation, enhancing scarcity and value.

Step 1: The project team or token holders decide to burn a certain number of tokens.

Step 2: These tokens are sent to a designated burn address.

Step 3: The transaction is recorded on the blockchain, making it transparent and verifiable.

Step 4: The cryptocurrency’s total supply is updated to reflect the reduced number of tokens in circulation.

The burn transaction is permanent and irreversible. These transactions are publicly visible on blockchain explorers, allowing anyone to verify that the tokens have been burned.

For example, if you wanted to burn Ethereum, you would send any amount of ETH to the Ethereum burn address: 0x0000000000000000000000000000000000000000.

Burn Addresses Explained

Burn addresses, also known as “eater” or “null” addresses, are cryptocurrency wallets specifically designed to be inaccessible.

These addresses can receive tokens but have no corresponding private key, ensuring that any cryptocurrency sent to them can never be withdrawn or spent.

On Ethereum, for instance, the common burn address is “0x 00000000000000000000000000000000,” which is easily recognizable and verifiable by blockchain explorers.

Why Do Projects Burn Tokens?

Projects implement token burning for various strategic purposes:

1. To Increase Scarcity and Potentially Drive Up Price

One fundamental reason for burning tokens is to control inflation. By reducing the total number of coins in circulation, projects can influence market dynamics such as price and market capitalization.

This follows basic economic principles—price tends to increase if demand remains constant while supply decreases.

The popularity of crypto burning started in 2017 following Binance Coin’s (BNB) token burn initiative. In 2018, tokens like Stellar (XLM), Bitcoin Cash (BCH), and Tron (TRX) also embraced crypto burning.

2. Proof-of-Burn (PoB) Consensus Mechanism

Some cryptocurrencies rely on burning at the infrastructure level. They employ the Proof of Burn (PoB) consensus mechanism, which requires nodes to burn a portion of their holdings to become eligible to validate new blocks.

Generally, the more tokens a participant burns, the greater their power in the consensus process. Like Proof-of-Stake (PoS), PoB creates a system where validators are incentivized to support the network’s long-term health.

In PoB, miners don’t need expensive computational devices or high electricity costs like in Proof-of-Work systems.

3. Tokenomics and Governance

Transparency and trust are crucial in the cryptocurrency world. Token burns demonstrate a project’s commitment to responsibly managing the token supply.

Coin burning can help safeguard blockchain networks from Distributed Denial-of-Service (DDoS) attacks by making them economically unfeasible.

The gradual decline of the token’s circulating supply also develops positive market sentiments among the crypto community.

4. Error Correction or Project Restructuring

While it goes mostly unnoticed, “mistake” burns are common. Bitcoin is the most famous example—whenever a user loses their hard drive or sends tokens to an invalid wallet address, those BTC are effectively burned.

According to some estimates, over 4 million BTC have been effectively burned, accounting for 20% of the total supply

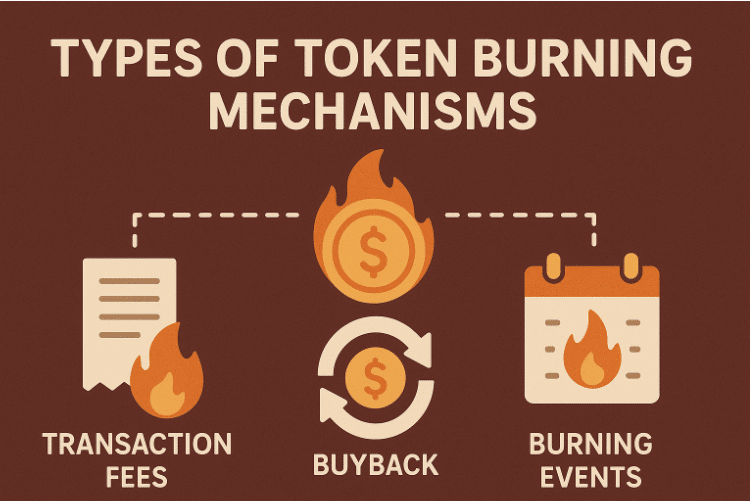

Types of Token Burning Mechanisms

Types of token burning mechanisms vary across projects, each using different methods to reduce supply and manage token value.

Manual Burns vs. Automatic Burns

Manual burns occur when project teams deliberately burn tokens at specific times. These burns are typically announced and executed through transparent transactions that the community can verify.

Automatic burning uses smart contracts to trigger burns based on set conditions, removing human involvement and boosting trust.

Scheduled Burns vs. Event-Triggered Burns

Scheduled burns follow a predetermined timeline and occur regularly regardless of market conditions. Binance’s quarterly token burns, adjusted by trading volume, are a prime example.

Event-triggered burns occur in response to specific events or thresholds being met. For example, Ripple burns a fraction of its transaction fees to prevent spam on the network.

Transaction Fee Burns

Some cryptocurrencies implement burns as part of their transaction fee structure. Ethereum implemented EIP-1559 in August 2021, which ensures that part of the gas fee is burned following every transaction.

This mechanism creates a direct relationship between network usage and burning rate.

Community-Driven Burns

Community-driven burns involve token holders voluntarily burning their tokens. For example, Shiba Inu (SHIB) increased its token burn to over 863% in June 2024, with the total number of SHIB burned tokens crossing 410 trillion.

How Does Burning Crypto Affect You?

Burning crypto can impact investors, project supporters, and the broader ecosystem by influencing token value, market perception, and overall stability.

For Investors

For cryptocurrency investors, token burning can affect portfolio value and investment strategy. Reducing supply through burning can increase value.

However, burning doesn’t guarantee price appreciation—market dynamics, project fundamentals, and broader crypto sentiment all play essential roles.

Even the highest burn rate won’t make a difference if a project lacks real utility.

For Project Followers

Token burns signal that a team is taking active steps to enhance the token’s value and stability. This can build confidence amongst traders.

Pay attention to process transparency, clear explanations, and verifiable on-chain evidence—these indicate responsible management.

For the Broader Ecosystem

Token burns contribute to a more stable supply, potentially reducing large-scale price fluctuations and creating a more predictable market environment.

Examples of Crypto Burning

Crypto burning is widely used across the industry to manage supply and support token value. Here are some key examples of crypto burning, each showcasing different burning approaches.

Binance Coin (BNB)

Binance’s burn schedule involves a buyback and burn mechanism using part of its revenue to buy back and burn tokens. In Q1 2024, Binance executed its 27th BNB burn, removing almost 2 million BNB worth ~$1.2 billion.

The plan is to eventually destroy 100 million BNB, leaving 100 million in circulation.

Ethereum (ETH)

The EIP-1559 update, introduced in August 2021, burns ether from transaction fees. According to data, over 3.25 million ETH (~$5.9 billion) have been burned since August 2021, reducing the number of ETH tokens in circulation.

Shiba Inu (SHIB)

In 2021, Vitalik Buterin destroyed almost half of all SHIB tokens, totaling around 410 trillion. Beyond this initial burn, Shiba Inu’s burn portal allows the community to continue burning tokens.

Benefits and Limitations Of Burning Crypto

Crypto burning offers several advantages but also comes with challenges. Here are the benefits and limitations of crypto burning.

Benefits

- Reduces the circulating supply, helping control inflation

- Rewards long-term holders by increasing their percentage of the total supply

- Creates transparency and accountability through on-chain verification

Limitations

- Small burns have a negligible impact relative to ample token supplies

- It can enable market manipulation if not implemented properly

- Faces uncertain regulatory treatment across different jurisdictions

- Burning alone doesn’t fix fundamental issues with a project’s utility or adoption

Suggested Posts:

Conclusion: Token burning is key to cryptocurrency economics and blockchain innovation!

Token burning is a powerful economic tool in cryptocurrency that permanently removes tokens from circulation to influence supply dynamics. This process can help reduce supply and potentially increase token value.

However, burns should be considered alongside a project’s utility, adoption, and overall vision, as burning alone does not guarantee success or price appreciation.

As cryptocurrency evolves, token burning remains an essential instrument, showcasing blockchain’s innovative approach to transparent, programmable monetary policy without relying on central authorities.

FAQs

No, once tokens are properly burned by sending them to a valid burn address, they cannot be recovered.

To verify token burns, transparent projects share the burn wallet address on their official website, social media, or Discord.

Burning removes tokens permanently by sending them to inaccessible addresses, while locking restricts them temporarily using time-based smart contracts.

Anyone can burn their tokens, though a significant economic impact typically requires coordinated efforts or substantial holdings.

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)