In 2025, figures such as Changpeng Zhao, Brian Armstrong, and Michael Saylor dominate the list, with their wealth stemming from crypto exchanges, blockchain platforms, and significant Bitcoin holdings.

The world of cryptocurrency has given rise to a new class of billionaires, whose fortunes are built on digital innovation, early adoption, and strategic investments.

This list highlights the top 10 crypto billionaires of 2025, ranked by estimated net worth and primary sources of wealth. It offers a snapshot of how visionaries turned emerging technologies into billion-dollar empires, navigating volatility, regulation, and competition along the way.

Here’s a closer look at the industry’s richest pioneers.

Top 10 Crypto Billionaires of 2025 List

| Rank | Name | Estimated Net Worth (USD) | Primary Source of Wealth |

|---|---|---|---|

| 1 | Changpeng Zhao (CZ) | $90 billion | Binance Founder |

| 2 | Brian Armstrong | $15 billion | Coinbase CEO |

| 3 | Michael Saylor | $10 billion | MicroStrategy & Bitcoin |

| 4 | Chris Larsen | $9.5 billion | Ripple Co-founder |

| 5 | Vitalik Buterin | $8 billion | Ethereum Creator |

| 6 | Winklevoss Twins | $7 billion each | Gemini Exchange |

| 7 | Jed McCaleb | $5 billion | Stellar & Mt. Gox |

| 8 | Joseph Lubin | $4.5 billion | ConsenSys & Ethereum |

| 9 | Barry Silbert | $4 billion | Digital Currency Group |

| 10 | Fred Ehrsam | $3 billion | Paradigm & Coinbase |

Note: These figures are estimates based on available information from October 2024 and may not reflect current market conditions

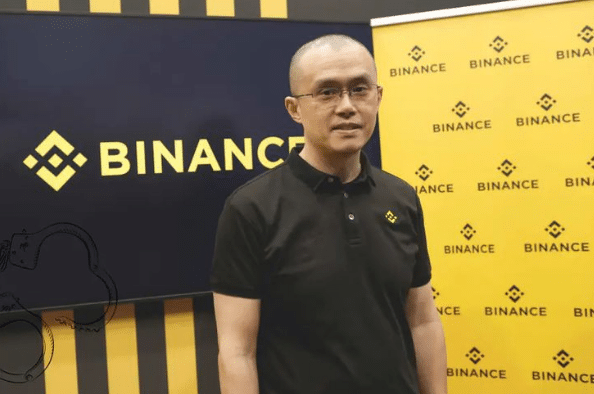

1. Changpeng Zhao (CZ)

| Net Worth (USD) | $90B |

| Crypto Asset (Ticker) | BNB |

| Crypto Fortune (USD) | $75B |

| Source of Wealth | Exchange ownership, BNB holdings |

Former Binance CEO who built the world’s largest cryptocurrency exchange. His wealth primarily stems from BNB holdings and Binance equity. Despite legal challenges, he remains the richest crypto figure due to his diversified investments and strategic planning.

In 2017, he launched Binance, becoming the largest crypto exchange by volume. He also introduced BNB, Binance Smart Chain, and Trust Wallet. In 2023, CZ pleaded guilty to money laundering, resulting in a $50 million fine, resignation as CEO, and possible prison time. Binance faced $4.3 billion in penalties.

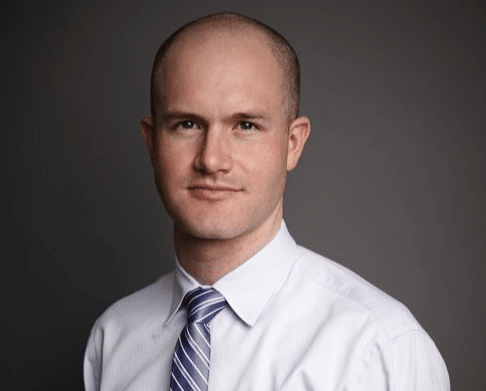

2. Brian Armstrong

| Net Worth (USD) | $15B |

| Crypto Asset (Ticker) | Multiple (COIN stock) |

| Crypto Fortune (USD) | $8B |

| Source of Wealth | Stake in Coinbase |

The Coinbase founder who took the company public in 2021. His wealth stems from his ownership of Coinbase stock and personal cryptocurrency holdings. Armstrong advocates for regulatory clarity and institutional adoption, expanding into various blockchain services beyond exchange operations.

Coinbase faced an SEC lawsuit in 2023 alleging illegal operation of an unregistered securities exchange. The company continues defending its business model in ongoing litigation.

Learn about the 10 biggest crypto scams in history here.

3. Michael Saylor

| Net Worth (USD) | $10B |

| Crypto Asset (Ticker) | BTC |

| Crypto Fortune (USD) | $9B |

| Source of Wealth | MicroStrategy & Bitcoin |

MicroStrategy’s executive chairman has transformed his software firm into a Bitcoin treasury. With over 150,000 BTC held corporately, he ranks as one of Bitcoin’s most outspoken institutional supporters, encouraging other companies to adopt cryptocurrency treasury practices.

Saylor transformed MicroStrategy into a “Bitcoin company,” acquiring over 200,000 BTC and becoming a symbol among Bitcoin fans. His strategy led to a 400% rise in MicroStrategy’s share price, encouraging other firms to consider BTC as a treasury reserve.

Interested in learning from top crypto experts? Check out the best crypto podcasts.

5. Chris Larsen

| Net Worth (USD) | $9.5B |

| Crypto Asset (Ticker) | XRP |

| Crypto Fortune (USD) | $8B |

| Source of Wealth | Ripple Co-founder |

Ripple co-founder holds billions in XRP. Despite SEC litigation, Larsen maintains wealth through diversified investments. He is involved in environmental initiatives and advocates for sustainable blockchain technology.

Ripple’s lengthy SEC lawsuit, alleging that XRP is an unregistered security, continues, with Larsen named as a defendant. The case has seen partial victories for Ripple but remains unresolved.

6. Vitalik Buterin

| Net Worth (USD) | $8B |

| Crypto Asset (Ticker) | ETH |

| Crypto Fortune (USD) | $7.5B |

| Source of Wealth | Ethereum Creator |

Vitalik Buterin’s wealth primarily stems from his role as a co-founder of Ethereum, a blockchain platform that enables the development of new cryptocurrencies and applications on a unified blockchain. He also co-founded Bitcoin Magazine in 2011, one of the earliest publications focused on cryptocurrencies.

Furthermore, Buterin was awarded a US$100,000 grant (equivalent to $132,823 in 2024) from the Thiel Fellowship, a scholarship established by venture capitalist Peter Thiel, which allowed him to dedicate himself to Ethereum on a full-time basis.

Want to understand Bitcoin better? Learn what Bitcoin is backed by here.

7. Winklevoss Twins

| Net Worth (USD) | $7B each |

| Crypto Asset (Ticker) | BTC |

| Crypto Fortune (USD) | $6B each |

| Source of Wealth | Gemini Exchange |

Harvard graduates and Olympic rowers who invested early Bitcoin settlement money wisely. They founded Gemini exchange, advocating for regulatory compliance while expanding into NFTs and institutional crypto services.

Gemini faced CFTC charges in 2022 for misleading statements about Bitcoin futures. They settled by paying $1 million while neither admitting nor denying wrongdoing.

8. Jed McCaleb

| Net Worth (USD) | $5B |

| Crypto Asset (Ticker) | XLM |

| Crypto Fortune (USD) | $4B |

| Source of Wealth | Stellar & Mt. Gox |

Jed McCaleb, known as a programmer and crypto innovator, established Stellar and was a co-founder of Ripple. He developed the Mt. Gox exchange and eDonkey networks, and initiated the Astera Institute to foster human potential and drive innovation.

As of April 2025, his net worth is $2.9 billion, making him one of the wealthiest individuals in the cryptocurrency industry. McCaleb launched the Astera Institute, focusing on human potential and innovation. He left the University of California, Berkeley, to pursue hands-on projects.

9. Joseph Lubin

| Net Worth (USD) | $4.5B |

| Crypto Asset (Ticker) | ETH |

| Crypto Fortune (USD) | $3.5B |

| Source of Wealth | ConsenSys & Ethereum |

Ethereum co-founder and ConsenSys founder, Lubin has amassed wealth through ETH and blockchain initiatives that promote enterprise adoption and Web3. His background in technology and finance has equipped him for the blockchain revolution.

After a robotics and neural networks career, he moved to financial technology, helping launch Ethereum with Vitalik Buterin. ConsenSys is vital for Web3 infrastructure, developing MetaMask and enabling enterprise blockchain across industries. His methodical approach navigates market fluctuations effectively.

10. Barry Silbert

| Net Worth (USD) | $4B |

| Crypto Asset (Ticker) | ETH, BTC |

| Crypto Fortune (USD) | $2.5B |

| Source of Wealth | Paradigm & Coinbase |

Digital Currency Group founder who built a crypto conglomerate including Grayscale Investments. His diversified portfolio encompasses multiple cryptocurrencies and blockchain companies, with a focus on institutional investment products.

DCG faced significant financial strain following the FTX collapse, with Genesis Global’s bankruptcy filing leading to creditor lawsuits over alleged fund mismanagement.

To explore another influential figure in the crypto world, check out how much cryptocurrency Elon Musk owns and the coins he publicly supports.

Investment Strategies of Crypto Billionaires

Cryptocurrency billionaires typically employ several key strategies:

- Early adoption and long-term holding

- Diversification across multiple digital assets

- Building infrastructure and platforms

- Regulatory compliance focus

- Institutional-grade services development

These strategies underscore the importance of both technological expertise and business acumen in the cryptocurrency sector.

Staying informed about such developments is essential, so consider following best cryptocurrency news platforms and websites for real-time updates and market trends.

The Future of Crypto Wealth

The landscape of crypto billionaires continues evolving with market dynamics, regulatory changes, and technological innovations. Emerging trends include:

- DeFi protocol development

- NFT marketplace creation

- Layer-2 scaling solutions

- Cross-chain interoperability

- Web3 infrastructure building

These areas represent potential opportunities for the next generation of crypto wealth creators.

More Suggested Reads:

Conclusion: Changpeng Zhao (CZ) Is The Richest Crypto Billionaire At $90 billion.

The top crypto billionaires of 2025 exemplify how early vision, calculated risk-taking, and technological innovation can build immense fortunes.

From leading exchanges to pioneering blockchain platforms, these individuals have shaped the cryptocurrency landscape while adapting to legal, market, and technological shifts.

As the crypto industry evolves, opportunities in DeFi, NFTs, Web3, and scaling solutions are creating new paths to wealth. However, rapid changes in regulation and market conditions mean fortunes can rise—or fall—swiftly.

The future billionaires of crypto will likely come from those who blend technical expertise with innovative, forward-looking strategies.

FAQs

They use multi-signature wallets, cold storage solutions, institutional custody services, and diversified storage strategies across multiple secure locations.

Most maintain 30-70% in crypto assets while diversifying into traditional investments, real estate, and venture capital.

Many focus on Layer-2 solutions, privacy coins, and Web3 infrastructure tokens, though specific investments remain private.

They employ sophisticated tax planning strategies, working with specialized crypto tax advisors to optimize their tax positions legally.

Many fund blockchain education, environmental sustainability projects, financial inclusion programs, and open-source development initiatives.