In 2025, Bitcoin has evolved from a fringe digital asset to a mainstream financial instrument with growing global adoption.

Following the major events of the previous year, including the approval of Bitcoin ETFs, the Bitcoin halving, and political shifts, the cryptocurrency market has undergone a dramatic transformation.

In this article, I examine the top 10 countries leading Bitcoin adoption in 2025, analyzing their regulatory frameworks, adoption rates, and economic factors driving cryptocurrency integration globally.

Let’s get started!

Top 10 Countries That Use Bitcoin in 2025

| Rank | Country | Adoption Rate | Primary Use Cases | Regulatory Status |

|---|---|---|---|---|

| 1 | El Salvador | 85% | Legal tender, payments, remittances | Fully legal |

| 2 | United States | 42% | Investment, institutional holdings, payments | Regulated |

| 3 | Switzerland | 38% | Banking integration, payments, investment | Crypto-friendly framework |

| 4 | Singapore | 36% | Trading, financial services, cross-border payments | Progressive regulation |

| 5 | United Arab Emirates | 33% | Investment, tourism, real estate | Encouraging framework |

| 6 | Argentina | 31% | Inflation hedge, savings, remittances | Partially regulated |

| 7 | Nigeria | 27% | Remittances, peer-to-peer trading, savings | Emerging regulation |

| 8 | Canada | 25% | Investment, ETFs, business integration | Clearly regulated |

| 9 | Ukraine | 23% | Remittances, donations, savings | Legalized |

| 10 | Brazil | 21% | Investment, payments, e-commerce | Regulatory framework in place |

Let us get into the details of these top 10 countries that use Bitcoin in 2025:

1. El Salvador

In 2021, El Salvador became the first country to adopt Bitcoin as legal tender, expecting this move to transform its economy by 2025. With 85% of Salvadorans using Bitcoin through the national Chivo wallet, GDP has increased by 12% since its implementation.

Remittance costs have plummeted from 10% to below 1%, resulting in an additional $900 million annually being brought into the economy. The Bitcoin Beach community has become a global case study for circular Bitcoin economies.

2. United States

The United States has emerged as a global leader in Bitcoin adoption, driven by institutional investment and regulatory clarity. Following the 2024 approval of spot Bitcoin ETFs, over $120 billion has been invested in these vehicles.

Major corporations now hold Bitcoin on their balance sheets, with Tesla, MicroStrategy, and Square collectively holding over 350,000 BTC. Wyoming, Texas, and Miami have emerged as crypto hubs with designated economic zones for blockchain businesses.

3. Switzerland

Switzerland’s Zug, known as “Crypto Valley,” has established itself as the leading global center for blockchain innovation. The Swiss Financial Market Supervisory Authority (FINMA) offers clear regulations for cryptocurrency companies, drawing in more than 1,000 blockchain startups.

In major cities, Bitcoin is accepted for daily transactions, with retailers taking BTC for items ranging from coffee to high-end watches. The payment infrastructure linking the Swiss franc to Bitcoin serves as a benchmark for other countries pursuing monetary innovation.

Switzerland is also home to some of the world’s most crypto-friendly banks, making it ideal for secure Bitcoin services.

4. Singapore

Singapore has established itself as Asia’s cryptocurrency hub through progressive regulation and technological infrastructure. The Monetary Authority of Singapore’s Payment Services Act provides clarity for digital asset businesses while ensuring consumer protection.

The city-state’s status as a financial hub has accelerated the integration of Bitcoin, with 80% of multinational corporations based there utilizing blockchain for cross-border transactions. Singapore’s universities provide robust blockchain education, fostering a pipeline of crypto talent.

5. United Arab Emirates

The UAE has used its wealth and vision to become a global cryptocurrency hub. Dubai’s Virtual Asset Regulatory Authority (VARA) offers a leading regulatory framework, while the Dubai Multi Commodities Centre hosts over 500 crypto companies, fostering a vibrant ecosystem.

Bitcoin is widely accepted in the tourism sector, with luxury hotels, restaurants, and shopping malls embracing cryptocurrency payments. The UAE’s zero personal income tax policy attracts global crypto entrepreneurs.

6. Argentina

Argentina embraces Bitcoin due to persistent inflation. Nearly one-third of Argentinians use Bitcoin to hedge against the devalued peso, losing 95% of its value against the USD since 2020. Crypto adoption is strong in Buenos Aires, with over 5,000 merchants accepting BTC payments.

The government body CNV has implemented a regulatory sandbox for cryptocurrency businesses, striking a balance between innovation and consumer protection measures. Bitcoin has become a crucial asset for preserving wealth in this volatile economy.

7. Nigeria

Nigeria tops Africa in Bitcoin adoption, fueled by its young, tech-savvy population seeking financial alternatives. Initially faced with government resistance, regulatory frameworks now support secure crypto transactions.

Peer-to-peer Bitcoin trading surpasses $400 million monthly, primarily for remittances and protection against naira instability. Mobile wallets now reach rural areas, offering financial services to millions. Lagos tech hubs develop Bitcoin solutions for African markets.

8. Canada

Canada has embraced Bitcoin through progressive regulation and financial innovation. The first Bitcoin ETFs worldwide launched in Canada, which now hosts over $15 billion in crypto fund assets.

Bitcoin mining with renewable energy thrives in Quebec and British Columbia, making up 3% of the global hashrate. The Bank of Canada collaborates with universities for CBDC research compatible with Bitcoin networks. Major retailers, including Tim Hortons, accept Bitcoin payments nationwide.

Learn more about crypto tax in Canada and how they impact investor returns.

9. Ukraine

Ukraine has leveraged Bitcoin to rebuild its war-torn economy and facilitate international aid. Following its 2022 legalization of cryptocurrencies, Ukraine received over $150 million in crypto donations for defense and reconstruction.

The government now holds Bitcoin reserves as part of its treasury strategy. Approximately 23% of Ukrainians use crypto regularly, particularly for preserving wealth and receiving overseas remittances. The country’s IT sector has pivoted toward blockchain development, creating a specialized export industry.

10. Brazil

Brazil’s Bitcoin adoption has been driven by institutional investment and growing public interest. The 2022 regulatory framework provided legal clarity, enabling major banks to offer crypto services. Nubank, Brazil’s largest digital bank, provides Bitcoin trading to over 60 million customers.

Brazil’s central bank is developing a CBDC that will interact with Bitcoin’s Lightning Network. The country’s vibrant crypto community has established Latin America’s largest Bitcoin conference, attracting global investment to the region.

Bitcoin Adoption Leaders By Continent In 2025

Here is a quick table to help you understand the breakdown of the adoption country-wise along with key Bitcoin adoption areas:

| Continent | Country 1 | Country 2 | Country 3 |

|---|---|---|---|

| North America | United States: Investment, institutional adoption | Canada: ETFs, mining, payments | Mexico: Remittances, inflation hedge |

| Europe | Switzerland: Banking, innovation hubs | Germany: Institutional investment, regulated services | Portugal: Tax advantages, digital nomad community |

| Asia | Singapore: Financial services, trading | UAE: Luxury market, investment | Japan: Retail adoption, tech integration |

| Africa | Nigeria: P2P trading, remittances | Kenya: Mobile money, micropayments | South Africa: Investment, cross-border commerce |

| South America | El Salvador: Legal tender, nationwide adoption | Argentina: Inflation hedge, savings | Brazil: Banking integration, investment |

| Oceania | Australia: Investment, regulated exchanges | New Zealand: Retirement funds, business adoption | — |

See Australia’s crypto tax rules to understand how it supports Bitcoin adoption.

How To Identify Bitcoin Friendly Countries?

Here’s a brief overview of what to consider when looking for a bitcoin-friendly country. For additional information, check out the full list of crypto tax-free countries that are drawing global Bitcoin adoption.

- Economic instability: Nations with high inflation or currency devaluation typically see faster Bitcoin adoption

- Young, tech-savvy population: Demographics heavily influence adoption rates

- Remittance-dependent economies: Countries relying on overseas transfers benefit from Bitcoin’s low fees

- Regulatory clarity: Nations with clear legal frameworks attract Bitcoin businesses and users

- High smartphone penetration: Mobile access enables Bitcoin adoption even with limited banking infrastructure

- Limited banking access: Countries with large unbanked populations can leapfrog to Bitcoin-based services

- Energy surplus: Nations with excess renewable energy are attractive for Bitcoin mining operations

Will Bitcoin Adoption Continue to Grow?

Given its dominance, institutional support, and central market role, Bitcoin’s adoption is expected to continue growing and may further establish it as a digital gold standard in a turbulent crypto ecosystem.

As of 2025, over 17,000 cryptocurrencies are in circulation, with Bitcoin and Ethereum accounting for nearly 75% of the market capitalization.

This suggests that, although innovation is abundant, trust is primarily vested in established players, particularly Bitcoin.

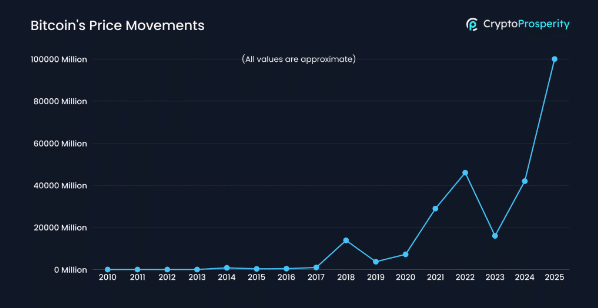

With a market capitalization of over $10 billion, Bitcoin remains a “high-cap” asset, appealing to both retail and institutional investors. Its leadership is highlighted by the $2.96 trillion global crypto market cap, with Bitcoin commanding a significant portion.

The ecosystem comprises 217 global exchanges, projected to generate $45.3 billion in revenue by 2025, with an estimated market penetration of 11.02%.

However, over 50% of cryptocurrencies have failed, emphasizing market volatility and reinforcing Bitcoin’s position as a reliable long-term store of value.

Also Read:

Conclusion: Bitcoin Is A Hedge Against Inflation, A Tool For Fintech Innovation & Financial Access

The global adoption of Bitcoin in 2025 reflects diverse motivations from economic necessity in Argentina to institutional investment in the United States.

El Salvador’s pioneering legal tender approach has demonstrated tangible economic benefits, while financial hubs like Switzerland and Singapore have leveraged regulatory clarity to attract blockchain innovation.

As Bitcoin continues to mature as both a store of value and medium of exchange, its integration into global financial systems appears inevitable, with these top 10 countries leading the way.

FAQs

Most analysts project Bitcoin reaching between $150,000-$250,000 by end-2025, driven by institutional adoption, reduced supply from halving events, and mainstream financial integration.

The United States leads in institutional Bitcoin purchases, with public companies and funds holding over 1.5 million BTC, while El Salvador leads in government Bitcoin treasury holdings.

While Bitcoin offers stability, emerging layer-2 solutions and specialized DeFi platforms show potential for exponential growth, though such returns come with extreme risk.

Projections suggest Bitcoin could reach $500,000-$1,000,000 by 2030 if adoption continues and it captures portions of the gold, bond, and international settlement markets.