The cryptocurrency industry has seen explosive growth over the last decade — but along with innovation came some of the Biggest Crypto Scams in financial history.

Between Ponzi schemes, rug pulls, and fraudulent exchanges, investors have lost over $60 billion globally to crypto scams.

From the $8 billion FTX collapse in 2022 to the $4.4 billion OneCoin Ponzi scheme, these scams have destroyed fortunes, ruined lives, and shaken trust in digital assets.

Here’s a detailed look at the Top 10 Biggest Crypto Scams of all time, based on the total amount lost, the year of the scam, and the key players behind them.

Top 10 Biggest Crypto Scams (Quick Table)

| Rank | Scam Name | Year | Amount Lost | Type | Key Player(s) |

|---|---|---|---|---|---|

| 1 | FTX Collapse | 2022 | $8+ Billion | Exchange Fraud | Sam Bankman-Fried (SBF) |

| 2 | OneCoin | 2014–2017 | $4.4 Billion | Ponzi Scheme | Ruja Ignatova |

| 3 | Africrypt | 2021 | $3.6 Billion | Exit Scam | Ameer & Raees Cajee |

| 4 | BitConnect | 2016–2018 | $2.4 Billion | Ponzi Scheme | Satish Kumbhani (Alleged) |

| 5 | Thodex | 2021 | $2 Billion | Exchange Exit | Faruk Fatih Özer |

| 6 | Terra/Luna | 2022 | $40+ Billion (Value) | Algo Depeg | Do Kwon |

| 7 | Celebrity Coins | 2021–2023 | $300+ Million | Pump & Dump | Kim K, Soulja Boy, Logan Paul |

| 8 | Forsage | 2020 | $300 Million | MLM/Ponzi | Lado Okhotnikov |

| 9 | PlusToken | 2018–2019 | $3+ Billion | Ponzi Wallet | Chinese & Korean Group |

| 10 | Squid Game Token | 2021 | $3.38 Million | Rug Pull | Anonymous Devs |

1. FTX Collapse – $8+ Billion (2022)

FTX was once considered the crown jewel of cryptocurrency exchanges, led by wunderkind Sam Bankman-Fried (SBF). However, the empire crumbled spectacularly when it was revealed that SBF had been secretly transferring customer funds to Alameda Research, his trading firm.

The catastrophe was triggered when Binance announced it would liquidate its FTX token holdings, sparking a devastating bank run. Within days, the entire operation collapsed, leaving investors with losses exceeding $8 billion.

SBF once celebrated for his seemingly genius approach to crypto markets (and his distinctive unkempt hair), now faces a 25-year prison sentence for fraud, conspiracy, and money laundering.

2. OneCoin – $4.4 Billion (2014–2017)

Marketing itself as the “Bitcoin Killer,” OneCoin represented one of cryptocurrency’s most elaborate Ponzi schemes. The fundamental problem? Despite all its marketing, OneCoin never actually had a blockchain.

The operation was masterfully orchestrated by Ruja Ignatova, who vanished mysteriously in 2017 after boarding a flight to Athens, Greece.

Ignatova, now known as the “Crypto Queen,” remains on the FBI’s Most Wanted list with a $5 million bounty for information leading to her arrest. The scheme defrauded investors of approximately $4.4 billion, making it one of the largest scams in cryptocurrency history.

3. Africrypt – $3.6 Billion (2021)

In a story that seems ripped from a Hollywood script, two teenage brothers from South Africa, Ameer, and Raees Cajee, created Africrypt, a cryptocurrency investment platform promising up to 10% monthly returns.

After amassing billions in investor funds, the brothers claimed their platform had been hacked before disappearing completely. Investigations revealed the funds had been meticulously laundered through tumblers and mixers, making them virtually untraceable.

Despite international efforts, no arrests have been made, with the brothers allegedly spotted living luxuriously in Tanzania, though their current whereabouts remain unknown.

4. BitConnect – $2.4 Billion (2016–2018)

Perhaps the most infamous crypto scam due to its meme-worthy promotional events, BitConnect promised investors returns of 1% daily through a proprietary “trading bot.”

In reality, it was an elaborate Ponzi scheme that collapsed in January 2018, wiping out over $2.4 billion in investor funds. You can read the whole case study here bdo.ca.

Source: Ian via YouTube

The face of BitConnect, Carlos Matos, became an internet meme sensation with his energetic “BiiiiitConnnneeeeect!” chant at a promotional event. Behind the scenes, founder Satish Kumbhani allegedly orchestrated the fraud, though legal proceedings are still ongoing.

5. Thodex – $2 Billion (2021)

Thodex stood as Turkey’s largest cryptocurrency exchange until its CEO, Faruk Fatih Özer, abruptly shut down the platform and fled the country with approximately $2 billion in investor funds.

The sudden disappearance left over 400,000 users unable to access their accounts.

After an international manhunt, Özer was apprehended and faced justice in Turkey, where he received one of the most severe sentences in financial crime history: over 11,000 years in prison, reflecting the magnitude of his fraud against hundreds of thousands of victims.

6. Terra/Luna – $40+ Billion in Value Wiped (2022)

Though not an intentional scam, the collapse of the Terra/Luna ecosystem stands as one of the worst failures in cryptocurrency history. Do Kwon created Terra’s algorithmic stablecoin UST to keep its value aligned with the US dollar through a complicated connection with the LUNA token.

When UST lost its peg in May 2022, it triggered a death spiral that erased over $40 billion in market value within days. Countless investors lost their life savings, and the collapse sent shockwaves throughout the entire cryptocurrency market.

Do Kwon fled but was eventually arrested in 2023 and has since been extradited to the United States to face securities fraud charges.

7. Celebrity Coins – $300M+ (2021–2023)

The cryptocurrency bull market of 2021 brought a wave of celebrity endorsements for various tokens, many of which turned out to be sophisticated pump-and-dump schemes.

Notable cases include Kim Kardashian promoted EthereumMax (which resulted in a $1.26 million SEC fine), Logan Paul’s CryptoZoo, and various tokens endorsed by Soulja Boy.

Celebrities promoted tokens for payment, causing price spikes before insiders dumped their holdings, leaving investors with worthless tokens. Many later claimed ignorance of the fraud, providing little help to those who lost millions.

8. Forsage – $300M (2020)

Marketed as a legitimate DeFi project utilizing Ethereum smart contracts, Forsage was a multilevel marketing (MLM) Ponzi scheme that defrauded approximately $300 million in investors.

The platform attracted participants with promises of sustainable returns through a “smart contract matrix.”

In 2023, the SEC charged co-founder Lado Okhotnikov and 11 others with fraud. If convicted in this litigation, Okhotnikov faces decades in prison for orchestrating one of the most sophisticated crypto Ponzi schemes masked as a legitimate blockchain investment opportunity.

9. PlusToken – $3+ Billion (2018–2019)

PlusToken began as a cryptocurrency wallet service that promised extraordinary monthly returns to users who deposited their crypto assets. The platform gained millions of users across Asia, particularly in China and South Korea, before operators vanished with over $3 billion in investor funds.

Before disappearing, the developers left a simple message: “Sorry, we have run.”

While Chinese authorities managed to arrest 6 individuals connected to the scheme, most of the stolen funds remain unrecovered, highlighting the challenges in tracking blockchain-based financial crimes.

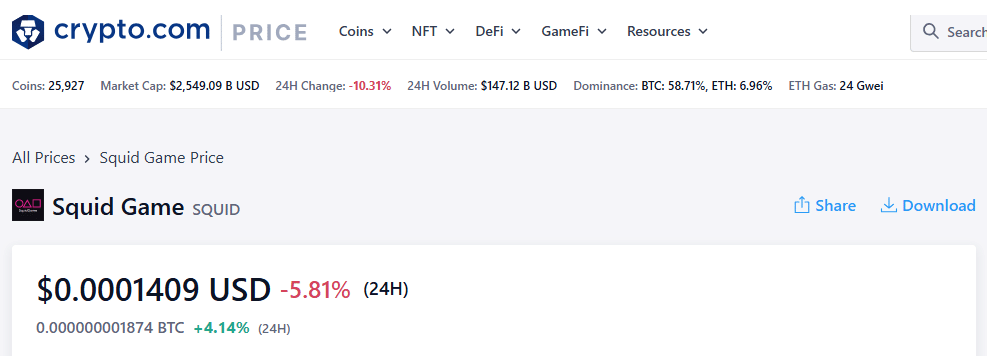

10. Squid Game Token – $3.38 Million (2021)

Capitalizing on the global popularity of Netflix’s hit series “Squid Game,” anonymous developers launched a themed cryptocurrency that surged by an astonishing 75,000% in value.

The catch? Investors could buy the token but couldn’t sell it due to liquidity restrictions.

In a classic “rug pull” maneuver, the developers suddenly withdrew all liquidity from the trading pools and disappeared with approximately $3.38 million. Within hours, the project’s website and social media accounts vanished, leaving investors with worthless tokens and no recourse.

Notable Crypto Scammers

The cryptocurrency world has produced a rogues’ gallery of financial criminals:

- Ruja Ignatova: The OneCoin founder remains at large, last seen in Athens, and is on the FBI’s Most Wanted list.

- Do Kwon: Terra’s founder, has been extradited to the United States to face securities fraud charges.

- Faruk Fatih Özer: The Thodex CEO is serving his sentence in Turkey.

- Lado Okhotnikov: Forsage’s co-founder faces SEC charges in the United States.

- Sam Bankman-Fried: The disgraced FTX founder is currently serving prison time.

How To Identify A Crypto Scam?

Protecting yourself begins with recognizing these common red flags:

- Promises of guaranteed high returns (legitimate investments never guarantee profits)

- Anonymous or unverifiable team members (lack of transparency about leadership)

- Absence of a working product or a comprehensive whitepaper

- Marketing driven primarily by influencers rather than genuine utility

- Restrictions on withdrawals or artificially locked tokens

- High-pressure sales tactics suggesting urgent action to avoid missing out

Can Victims Recover Funds?

Unfortunately, recovery of funds from cryptocurrency scams is extremely rare. Blockchain transactions’ decentralized, pseudonymous nature makes it exceptionally difficult to trace and recover stolen assets.

However, in cases where scammers are identified and apprehended, victims may have some recourse through:

- Legal proceedings and lawsuits

- Cryptocurrency forensics investigations

- Class action lawsuits against the project founders

- Asset seizure by law enforcement agencies

Nonetheless, prevention remains far more effective than attempting recovery after a scam has occurred.

Related Reads:

Conclusion: Top 10 Biggest Crypto Scams Wiped Out Over $65 Billion

In total, the top 10 biggest crypto scams wiped out over $65 billion from investors across the globe.

These scams range from fake exchanges like Thodex ($2 billion lost) and Ponzi schemes like BitConnect ($2.4 billion) to large-scale collapses like Terra/Luna, which alone erased $40+ billion in market value.

The masterminds behind these scams — from Sam Bankman-Fried (FTX) to Ruja Ignatova (OneCoin) — now serve as cautionary tales for the crypto industry.

While cryptocurrency offers huge potential, these scams remind us that extreme returns often come with extreme risks, and due diligence is essential before investing.

FAQs

Likely Satoshi Nakamoto, Bitcoin’s pseudonymous creator, is believed to hold over 1 million BTC.

In most jurisdictions, cryptocurrency transaction profits are taxable regardless of whether you’ve withdrawn to fiat currency.

Guaranteed returns are the most significant warning sign, as legitimate investments always carry risk.

While challenging, options include reporting to authorities, utilizing blockchain forensics services, and pursuing legal action, though recovery rates remain low.

Changpeng Zhao (CZ), Binance’s founder, was once considered the wealthiest person in the crypto space, though his net worth has fluctuated significantly with market conditions and legal challenges.

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)