Cryptocurrency is completely legal in Canada. The Canadian government allows the use of cryptocurrency, but it’s not considered legal tender.

This article examines Canada’s cryptocurrency regulations, tax implications, and future outlook. We’ll explore the legal framework governing digital assets, clarify whether you can use crypto for everyday transactions, and outline the government’s approach to this evolving technology.

Cryptocurrency Laws in Canada – Is it Legal?

Cryptocurrency is perfectly legal to use in Canada. The government even has an official page devoted to digital currencies, stating that Canadians may use cryptocurrencies to buy services or goods at retailers that accept them. Canadians can also buy and sell almost all types of cryptocurrencies on open digital exchanges similar to a traditional stock market.

However, unlike the Canadian dollar, crypto assets are not legal tender in Canada. They are not issued or overseen by a government or central bank. Crypto assets are also quickly evolving, unstable, and complex, which is why authorities recommend learning more about their risks before investing or using them.

Canada has been proactive in addressing cryptocurrency regulation. In 2014, Canada became the first nation to establish laws addressing cryptocurrency by amending the Proceeds of Crime and Terrorist Financing Act (PCA) to cover all persons or entities dealing in cryptocurrencies. This early regulatory approach reflected the government’s cautious stance toward digital assets, seeing them as technology with potential benefits but also risks that needed oversight.

Unlike some countries that have classified cryptocurrencies as payment methods similar to traditional fiat currencies, the Canadian government took a different approach.

As defined in Section 8 of Canada’s Currency Act, only bank notes issued and coins minted by the Bank of Canada are given the status of legal tender. Because cryptocurrencies are not minted by the Bank of Canada, they are not legal tender but are considered commodities by the Canada Revenue Agency (CRA).

Canada’s regulatory structure adds complexity to cryptocurrency oversight, as the authority to regulate securities, property, and other rights is delegated to each province. Unlike the United States with its Securities and Exchange Commission, Canada does not have a federal securities regulator. This creates a multi-layered regulatory environment where users must navigate both federal and provincial requirements.

To address this regulatory asymmetry, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), a federal agency similar to FinCEN in the United States, received authority from the 2014 PCA amendment to bring cryptocurrency in its scope, subjecting cryptocurrency users and businesses to FINTRAC’s oversight and to PCA’s regulations.

Money Service Businesses (MSBs) Requirements

The PCA classifies persons or entities “dealing in virtual currencies” as money service businesses (MSBs). A Canadian business or trader using cryptocurrency in a “business-like manner” may be considered an MSB and subjected to the PCA. This determination is based on: frequency of transactions; duration of ownership; knowledge of matter; relationship to the user’s business; and time spent financing and advertising.

All MSBs must register with FINTRAC and abide by the PCA’s Anti-Money Laundering (AML) and compliance requirements. These requirements include maintaining records, reporting suspicious or terrorist-related activity, property transactions, and evaluating customers to determine if they are politically exposed persons. Cryptocurrency MSBs that receive $10,000 or more in a single transaction are required to report to FINTRAC, unless the funds are received by a financial institution.

Canadian banks are not allowed to open accounts with MSBs that are not registered with FINTRAC. This requirement ensures that cryptocurrency businesses operate within the established regulatory framework.

Are Crypto Assets Legal Tender in Canada?

While cryptocurrency is legal to use in Canada, it is not legal tender. That’s because the government only recognizes the Canadian dollar as the official currency of Canada; legal tender is defined as notes issued by the Canadian Bank and coins from the Royal Canadian Mint Act.

Unlike the Canadian dollar, crypto assets are not legal tender in Canada. A government or central bank doesn’t issue or oversee them. This distinction has several important implications for how cryptocurrency can be used in daily life.

Knowing the difference is crucial for multiple reasons. Financial institutions in Canada do not oversee or manage cryptocurrencies. So, apart from not being regulated, cryptocurrencies are also not supported by any central authority.

As a result, the types of transactions for which you can use cryptocurrency are limited. Because cryptocurrency is not legal tender, no one is required to accept it. And Canadians cannot use it for paying taxes or making other government-related payments.

The fact that crypto is not legal tender also means that it comes with fewer protections. This means there is no federal or provincial insurance on cryptocurrency like there would be with a savings account that holds Canadian dollars.

If a merchant is willing to risk it, however, they may accept whatever payment they choose, like most countries accept Bitcoin. It’s a similar case to businesses along the border who take U.S. dollars as payment, even though they are not considered legal Canadian tender.

Risks of Using Crypto Assets

Using crypto assets comes with many risks. Someone may hack into the technology or platforms used for crypto assets, like online wallet companies or crypto exchanges. They can steal your keys and gain access to your wallets and your crypto assets.

Crypto assets, including stablecoins, are risky investments because their value may rise and fall suddenly and significantly. These changes in value are hard to predict. When you exchange your crypto assets for traditional currency, they may be worth much less than when you bought them.

Any person or company that trades or advises in securities or derivatives must register with a provincial or territorial securities regulator. A crypto asset trading platform (CTP), depending on how it operates, may be subject to securities regulation. Lack of regulation of crypto assets also limits your protection.

Federal and provincial/territorial deposit insurance plans don’t cover crypto assets. For example, the Canada Deposit Insurance Corporation (CDIC) covers eligible deposits in Canadian dollars at member financial institutions if the institution fails. If the crypto trading platform or wallet provider that has your crypto assets goes out of business or becomes bankrupt, you may lose your money.

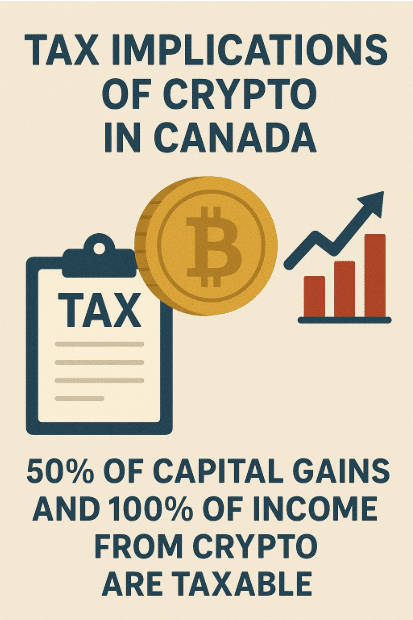

Tax Implications of Cryptocurrency in Canada

When it comes to paying taxes, crypto is like any other investment. Losses or gains will need to be recorded on Canadian’s yearly tax return since it doesn’t come in crypto tax-free countries. The Canadian government states that the Income Tax Act and tax rules apply to digital currencies. Authorities affirm that using digital currency does not exempt Canadians.

This means that the Financial Consumer Agency requests Canadians report any losses or gains from buying and selling or mining digital currencies when they file their taxes. Resulting losses and gains may be considered taxable income for the taxpayer.

The Canadian government also conveniently offers a guide to help taxpayers declare their cryptocurrencies on their taxes. The most important information is that Canadians pay taxes on capital gains or business income, depending on the situation.

At a minimum, any transaction utilizing cryptocurrency invokes the CRA’s policy on barter transactions because cryptocurrencies are a commodity. As cryptocurrency is geographically fluid, a Canadian user can find themselves subjected to various jurisdictions and agencies, depending on the location and activities of the user.

Canadians who hold crypto in offshore accounts, funds, or invest in entities that deal in crypto are still subject to Canadian regulations and tax. If the offshore entity does not make regular distributions, then the holder’s securities are considered annual income, which must be reported.

Future of Crypto and Blockchain in Canada

Although Canadians are restricted in their use of cryptocurrency and blockchain technology, the Canadian government has attempted to embrace the technology, although cautiously. In 2015, the Bank of Canada initiated Project Jasper, an experiment for the bank to heighten their understanding of blockchain technology.

In Phase One, the bank utilized a distributed ledger (DLT) to facilitate high-value interbank payments in hopes of achieving greater efficiency for its payment and settlement operations. The bank has completed two additional phases, applying DLT to other transactions, and is currently in Phase Four to experiment with the use of DLT to cross-border payments.

The willingness of the government to integrate DLT into their core functions may aid the future regulations of blockchain and cryptocurrency technology as the government finds the technology beneficial.

The Canadian government has addressed cryptocurrency in their markets without completely denying the economic opportunities cryptocurrencies offer. Initial Coin Offerings (ICOs) are permitted but also subjected to existing and developing regulations. Existing Canadian securities laws are applied to cryptocurrencies to give ICOs a degree of legal recognition as a security.

Other advancements by the Canadian government has widened the acceptance and legitimacy of blockchain and cryptocurrency technology. In 2018, the Ontario Securities Commission approved Canada’s first blockchain ETF, which is currently trading on the Toronto Stock Exchange, with more blockchain ETFs pending approval.

Another concrete step taken to accommodate cryptocurrency in Canada has been the proposal by the Canadian Department of Finance to simplify federal sales tax on certain transactions involving virtual payment instruments (VPI). Transactions involving VPI, applicable to many cryptocurrency transactions and exchanges, would be exempt from federal sales tax as a financial instrument.

Suggested Reads:

Conclusion: Crypto is Legal in Canada, but it is not legal tender

Cryptocurrency occupies a unique position in Canada’s financial landscape. While it’s completely legal to buy, sell, and trade crypto assets, they are not recognized as legal tender. Instead, they’re classified as commodities, subject to the rules and tax implications that apply to similar investments.

The Canadian government has taken a balanced approach to cryptocurrency regulation, seeking to protect consumers and prevent financial crimes while also exploring the potential benefits of blockchain technology through initiatives like Project Jasper. This dual approach demonstrates a recognition of both the risks and opportunities presented by digital assets.

For Canadians interested in using or investing in cryptocurrency, it’s essential to understand the regulatory requirements, particularly regarding tax obligations and MSB registration if operating at a business level. The evolving nature of cryptocurrency regulation means that users should stay informed about changes to ensure compliance.

As blockchain technology and cryptocurrencies continue to develop, Canada’s regulatory framework will likely evolve as well. The government’s willingness to explore blockchain applications suggests a future where digital assets may become more integrated into Canada’s financial system, albeit with appropriate safeguards.

FAQs

Yes, buying cryptocurrency is completely legal in Canada. You can purchase crypto through exchanges, trading platforms, or even Bitcoin ATMs located throughout the country.

The CRA treats cryptocurrency as a commodity, and you must report gains or losses when filing your taxes. These may be taxed as either capital gains or business income, depending on your specific circumstances.

You can use cryptocurrency for purchases if the merchant accepts it. However, since crypto is not legal tender, no business is required to accept it as payment.

It depends on the scale and nature of your activities. If you’re trading cryptocurrency in a “business-like manner” (frequently trading, short duration of ownership, etc.), you may be considered a Money Service Business and required to register with FINTRAC.

Cryptocurrency exchanges that operate in Canada may be subject to securities regulations depending on how they operate. Many are required to register with provincial securities regulators and comply with anti-money laundering regulations.

No, cryptocurrencies are not covered by federal or provincial deposit insurance plans like the Canada Deposit Insurance Corporation (CDIC). If a crypto platform or wallet provider goes bankrupt, you may lose your assets.

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)