The 2025 Cryptocurrency Adoption and Consumer Sentiment Report by Security.org reveals that 69% of current cryptocurrency holders maintain a market value gain. This highlights cryptocurrency as a viable financial investment.

Are you tired of just observing while digital currencies transform the financial market?

Cryptocurrency has evolved from a niche interest to a significant investment opportunity. Despite market fluctuations and regulatory uncertainties, digital currencies are increasingly being adopted globally.

Here are a few reasons that encouraged me to start investing in cryptocurrencies!

Summary of 10 Reasons to Invest in Cryptocurrency

| No. | Reason | Why? |

|---|---|---|

| 1 | High Growth Potential | Crypto has outperformed traditional assets over time. |

| 2 | Portfolio Diversification | Crypto adds a non-correlated asset to reduce overall risk. |

| 3 | Inflation Hedge | Limited-supply coins like Bitcoin can protect against inflation. |

| 4 | Inclusive Access | Crypto enables global access, even for the unbanked. |

| 5 | Blockchain Innovation | Supports groundbreaking tech beyond just currency. |

| 6 | Institutional Adoption | Big firms and banks are investing in crypto. |

| 7 | Global Payments | Enables fast, low-cost international transfers. |

| 8 | Clearer Regulations | 2025 laws are stabilizing the crypto space. |

| 9 | Financial Empowerment | Puts control in users’ hands, not banks. |

| 10 | Passive Income Opportunities | Earn via staking, lending, or yield farming. |

Now, let’s explore each of these reasons in detail:

1. Reason #1: High Potential for Long-Term Growth

Long-term investors can achieve substantial returns despite fluctuations. Cryptocurrencies are volatile yet have grown significantly. Bitcoin, the blockchain leader, benefits from limited supply and acceptance by traditional institutions. (2025 Cryptocurrency Adoption and Consumer Sentiment Report by Security.org).

Recent research shows major financial analysts are bullish on cryptocurrency’s growth. Some projects predict significant price increases for leading cryptocurrencies soon.

2. Reason #2: Portfolio Diversification

Smart investing principles emphasize diversification to manage risk. Cryptocurrencies offer a unique asset class that often moves independently of traditional markets like stocks and bonds.

This non-correlation can provide portfolio protection during traditional market downturns. Financial experts increasingly recommend allocating a small portion of investment portfolios to digital assets as part of a complete diversification strategy.

3. Reason #3: Protection Against Inflation

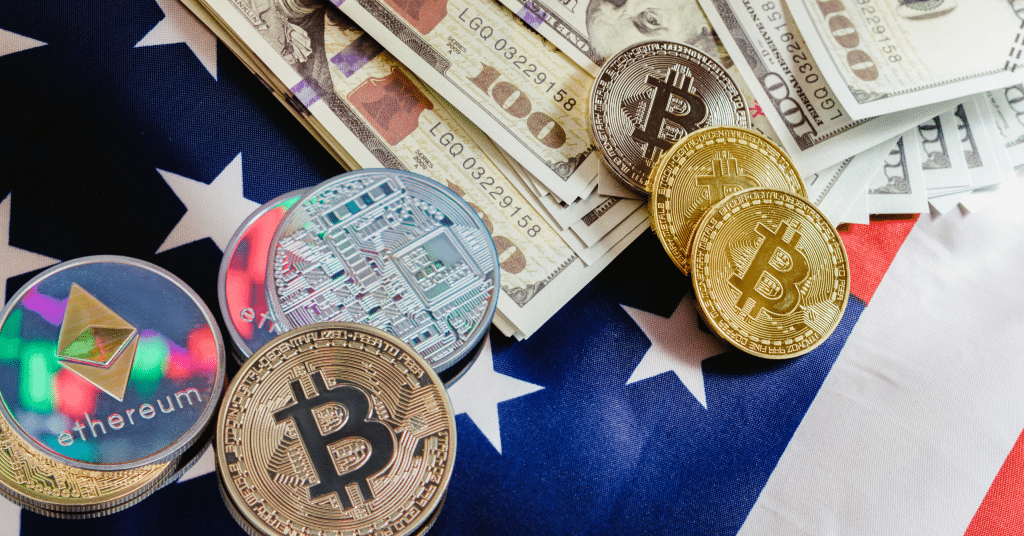

With governments worldwide expanding monetary supply, inflation concerns loom large for investors. Bitcoin and other cryptocurrencies with capped supplies offer potential protection against currency devaluation.

As traditional fiat currencies face inflationary pressures, limited-supply cryptocurrencies may serve as digital alternatives to conventional inflation hedges like gold.

4. Reason #4: Accessibility and Inclusivity

Cryptocurrency provides financial services access to those traditionally excluded from banking systems. With just a smartphone and an internet connection, anyone can participate in the global economy.

This democratization of finance helps bridge economic disparities and enables financial participation without the need for traditional banking relationships or credit histories.

5. Reason #5: Blockchain Technological Innovation

Investment in cryptocurrency supports the development of blockchain technology, which has applications far beyond digital currencies. From supply chain management to healthcare data security, blockchain offers transformative solutions to numerous industries.

By investing in crypto, you’re supporting technological innovation that could fundamentally reshape how many sectors operate.

6. Reason #6: Increasing Institutional Adoption

Major corporations and financial institutions now hold cryptocurrency on their balance sheets and offer crypto-related services. According to Motley Fool Money’s 2025 Cryptocurrency Investor Trends Survey, 50% of respondents believe the cryptocurrency market will perform positively in 2025, given recent political developments.

This institutional embrace lends legitimacy to the cryptocurrency market and suggests potential for continued mainstream integration.

7. Reason #7: Global Payment System

Cryptocurrency facilitates borderless, almost instantaneous transactions at much lower costs compared to conventional international transfers. It allows for the online transfer of value without intermediaries such as banks or payment processors, enabling global value transfers nearly instantly, around the clock, for minimal fees.

This efficiency benefits both individuals and businesses involved in international trade or remittances.

8. Reason #8: Growing Regulatory Clarity

The regulatory body for cryptocurrencies continues to evolve, with 2025 bringing more clarity than ever before. According to the Sumsub Crypto Industry Research Survey 2024, jurisdictions that were early adopters, especially in Asia and the Middle East, are now reaping the benefits.

As regulations mature, they provide greater certainty for investors and additional safeguards against fraud.

9. Reason #9: Democratization of Finance

Cryptocurrency shifts financial power from centralized institutions to individuals. This decentralization allows direct peer-to-peer transactions without intermediaries collecting fees or imposing restrictions.

The removal of these intermediaries signifies a fundamental redefinition of the operational dynamics within financial systems, thereby granting increased control to individual participants.

10. Reason #10: Potential for Passive Income

In addition to price appreciation, cryptocurrencies present various avenues for generating passive income. Staking, which involves participating in transaction validation, liquidity provision, and cryptocurrency lending platforms, provides opportunities to earn yields on digital asset holdings.

These mechanisms establish income streams that are analogous to interest or dividends in traditional finance, often accompanied by the potential for higher returns.

Are There Reasons Not To Invest In Cryptocurrency?

While the potential benefits are compelling, responsible investment requires acknowledging the risks.

A cryptocurrency’s value can change constantly and dramatically, and there’s no guarantee that values will rise again after falling.

Here are the cryptocurrency risks as pointed out in a US government research, along with a few that I have gathered over the years:

- Volatility Risk: Cryptocurrency prices can experience dramatic swings in short timeframes, making them unsuitable for risk-averse investors or those with short time horizons.

- Regulatory Uncertainty: Despite progress, regulatory frameworks remain in flux globally, creating potential for adverse regulatory actions affecting investments.

- Security Concerns: Although the underlying cryptography and blockchain are generally secure, the technical complexity of using and storing crypto assets can be a significant hazard to new users.

- Environmental Impact: Some cryptocurrencies, particularly those using proof-of-work consensus mechanisms, have significant energy consumption footprints.

- Market Manipulation: The relatively smaller market size of traditional assets makes cryptocurrencies susceptible to price manipulation.

Is It Safe To Invest In Bitcoin Today? (Risks Vs Rewards)

The value of even the most popular cryptocurrencies like Bitcoin has been volatile. The market isn’t very transparent compared to stocks, transactions are irreversible, and consumer protections are minimal or nonexistent.

However, introducing bitcoin ETFs in 2024 and growing institutional adoption have added legitimacy to the market. The safety of Bitcoin investment depends largely on your risk tolerance, investment horizon, and portfolio allocation.

Bitcoin may be considered safer than newer or smaller cryptocurrencies due to its market dominance, regulatory progress, and institutional backing. However, it still carries significant risks compared to traditional investments.

When considering a Bitcoin investment, here is what you should consider:

- Only invest what you can afford to lose

- Taking a long-term perspective

- Understanding the technology fundamentals

- Securing your assets properly

- Maintaining appropriate portfolio allocation

How Much To Invest In Crypto Per Month?

The appropriate monthly crypto investment depends on your financial situation, goals, and risk tolerance. Most financial experts recommend not investing more than you can afford to lose and limiting crypto exposure to less than 5% of your total portfolio.

For beginners, consider these guidelines:

- Start Small: Consider putting in a small sum, such as $10 or $50, to learn how to buy and hold Bitcoin.

- Use Dollar-Cost Averaging: Regular, fixed investments help manage volatility risk and avoid timing the market.

- Adjust Based on Risk Tolerance: If you are risk-averse, you should aim to invest 5% to 10% of your investment capital in crypto.

- Consider Your Time Horizon: Longer investment horizons can withstand greater volatility, potentially justifying higher allocations.

- Evaluate Your Financial Foundation: Ensure emergency funds and retirement savings are adequately funded before allocating to higher-risk investments.

Also Read:

Conclusion

Cryptocurrency is a transformative financial innovation with potential benefits for risk-aware investors. The ten reasons above show why digital assets are worth considering for modern investment portfolios.

However, prudent investment requires caution alongside enthusiasm.

By beginning with appropriate allocation sizes, using dollar-cost averaging, conducting thorough research, and adhering to security best practices, investors can join the cryptocurrency revolution while managing risks.

As the market matures and institutional adoption increases, cryptocurrencies, including Dogecoin, may transition from speculative assets to integral parts of the global financial system.

The cryptocurrency journey demands education, patience, and risk management, but for thoughtful participants, it presents unique opportunities in significant financial innovation.

FAQs

Investing $1,000 in Bitcoin in May 2020, when it was $9,000, would have yielded tremendous growth. By early 2025, Bitcoin surpassed $100,000, making the investment worth over $11,000, reflecting a return of over 1,000%.

Earning $1,000 monthly with cryptocurrency is possible through trading, staking, yield farming, and lending. However, the capital needed varies based on market conditions and risk. Higher returns usually involve greater risk and volatility.

Investing $100 in Bitcoin is a valuable entry point to understand cryptocurrency markets with minimal risk. Although returns on $100 will be modest, this strategy helps beginners learn crypto investing mechanics before investing larger amounts.

In 2015, Bitcoin traded at about $240. A $1 investment then is now worth around $416, showing a 41,600% return. This growth illustrates Bitcoin’s long-term investment potential, though past performance doesn’t guarantee future results.

Optimal investments depend on individual circumstances, goals, and risk tolerance. A diversified portfolio includes stocks, bonds, real estate, and alternatives like cryptocurrency. Index funds typically outperform cryptocurrencies and present less risk. For crypto, consider established options like Bitcoin and Ethereum, while diversifying among several cryptocurrencies.

![Crypto Tax Free Countries In 2025 [Updated List]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Crypto-Tax-Free-Countries-1-1024x536.png)

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)