As of April, 2025, the cryptocurrency market shows a hierarchy by unit price. Bitcoin (BTC) leads at $92,559.36 per coin, making it significantly more expensive than most other cryptocurrencies.

Closely following are Wrapped Bitcoin (WBTC) at $92,648.54 and Coinbase Wrapped BTC (CBBTC) at $92,724.23, which maintain a near 1:1 peg with Bitcoin.

Other notable cryptocurrencies include PAX Gold (PAXG) at $3,337.92 and XAUt at $3,336.22, both asset-backed tokens reflecting the value of physical gold.

While less discussed, ULTIMA also has a high price of $19,389.68 per unit.

To provide a more precise comparison and initial context, let’s get into the details.

Top 10 Most Expensive Cryptocurrencies: quick Overview (2025)

Here is the quick overview of most expensive cryptocurrencies in the world.

| Rank | Cryptocurrency Name | Symbol | Price per Unit (USD) | Market Capitalization (USD) |

|---|---|---|---|---|

| 1 | Bitcoin | BTC | $92,559.36 | $1.84T |

| 2 | Coinbase Wrapped BTC | CBBTC | $92,724.23 | $3.73B |

| 3 | Wrapped Bitcoin | WBTC | $92,648.54 | $11.95B |

| 4 | ULTIMA | – | $19,389.68 | $725.35M |

| 5 | PAX Gold | PAXG | $3,337.92 | $786.91M |

| 6 | Tether Gold | XAUt | $3,336.22 | $822.46M |

| 7 | yearn.finance | YFI | $9,154.20 | $304.81M |

| 8 | Maker | MKR | $2,645.10 | $2.45B |

| 9 | Bitcoin SV | BSV | $147.84 | $2.91B |

| 10 | Ethereum | ETH | $3,185.79 | $383.27B |

Note: Prices fluctuate rapidly. All values are approximate as of April 2025.

1. Bitcoin (BTC)

| Detail | Info |

|---|---|

| Price | $92,559.36 |

| Market Cap | $1.84 trillion |

| Token Supply | 21 million max |

| Blockchain | Bitcoin |

| Use Case | Digital store of value |

| Buy It Here | Bitcoin |

Bitcoin remains the most trusted and widely adopted cryptocurrency. Its finite supply and growing demand from institutions make it a digital equivalent of gold. As the original decentralized currency, it sets the benchmark for all crypto assets and continues to influence the entire ecosystem.

2. Coinbase Wrapped Bitcoin (CBBTC)

| Detail | Info |

|---|---|

| Price | $92,724.23 |

| Market Cap | $3.73 billion |

| Token Supply | Pegged 1:1 with BTC |

| Blockchain | Ethereum (ERC-20) |

| Use Case | DeFi, interoperability |

| Buy It Here | Coinbase |

Coinbase Wrapped Bitcoin enables Bitcoin holders to utilize their assets in Ethereum-based DeFi applications. Each token is backed by a real BTC held by Coinbase, ensuring price parity. It allows high-value BTC users to stake, lend, or trade without leaving the Ethereum ecosystem.

3. Wrapped Bitcoin (WBTC)

| Detail | Info |

|---|---|

| Price | $92,648.54 |

| Market Cap | $11.95 billion |

| Token Supply | Pegged 1:1 with BTC |

| Blockchain | Ethereum (ERC-20) |

| Use Case | Liquidity in DeFi |

| Buy It Here | Use Your Favourite Platforms |

WBTC enhances Bitcoin’s usability by wrapping it as an ERC-20 token. Fully backed and auditable, it serves as a cornerstone in DeFi protocols such as Aave, Compound, and Uniswap. It provides BTC holders with liquidity and utility in decentralized applications without compromising value.

4. ULTIMA

| Detail | Info |

|---|---|

| Price | $19,389.68 |

| Market Cap | $725.35 million |

| Token Supply | Limited (low float) |

| Blockchain | Private/Unknown |

| Use Case | Investment-focused |

| Buy It Here | ULTIMA |

ULTIMA is one of the lesser-known but priciest tokens in 2025. Its high unit price is largely due to extremely limited circulation. Though not yet widely adopted, its exclusivity attracts investors aiming to hold rare assets with speculative long-term potential.

5. yearn.finance (YFI)

| Detail | Info |

|---|---|

| Price | $9,154.20 |

| Market Cap | $304.81 million |

| Token Supply | 36,666 max supply |

| Blockchain | Ethereum (ERC-20) |

| Use Case | DeFi yield farming governance |

| Buy It Here | Use Your Favourite Platforms |

YFI’s high price is driven by its limited supply and essential role within the Yearn ecosystem. As a governance token, it enables holders to shape decisions within the DeFi protocol. Its DeFi legacy and scarcity continue to drive its price despite newer protocols entering the scene.

Important Note: Yearn.finance (YFI) is down $103.02 in 24h and far below its $90,787 ATH; it’s available on Binance, Coinbase, and Kraken, requiring an ERC-20 compatible wallet and verified exchange account for purchase.

6. Tether Gold (XAUt)

| Detail | Info |

|---|---|

| Price | $3,336.22 |

| Market Cap | $822.46 million |

| Backing | 1 troy ounce of gold |

| Blockchain | Ethereum & Tron |

| Use Case | Gold-backed stablecoin |

| Buy It Here | Tether |

Tether Gold offers a secure bridge between traditional gold and blockchain. Every token is backed by real gold held in Swiss vaults. For investors seeking a hedge against inflation but within the crypto space, XAUt is an appealing and regulated option.

7. PAX Gold (PAXG)

| Detail | Info |

|---|---|

| Price | $3,337.92 |

| Market Cap | $786.91 million |

| Backing | 1 troy ounce of gold |

| Blockchain | Ethereum |

| Use Case | Gold tokenization |

| Buy It Here | Paxos |

PAXG is issued by Paxos and directly backed by physical gold. Regulated by the New York Department of Financial Services (NYDFS), it ensures trust and transparency. Investors can digitally trade gold while retaining the right to physical delivery, blending the security of metal with the ease of cryptocurrency.

8. Ethereum (ETH)

| Detail | Info |

|---|---|

| Price | $3,185.79 |

| Market Cap | $383.27 billion |

| Token Supply | Dynamic |

| Blockchain | Ethereum |

| Use Case | Smart contracts, dApps |

| Buy It Here | Ethereum |

Ethereum powers the vast majority of DeFi and NFT projects. With Ethereum 2.0 now live, it boasts improved scalability and energy efficiency. ETH remains a foundational token in the blockchain space, continually evolving in response to developer innovation and ecosystem expansion.

9. Maker (MKR)

| Detail | Info |

|---|---|

| Price | $2,645.10 |

| Market Cap | $2.45 billion |

| Token Supply | Dynamic (burned over time) |

| Blockchain | Ethereum |

| Use Case | Governance of DAI stablecoin |

| Buy It Here | MakerDAO |

MKR enables decentralized governance over the DAI stablecoin. Token holders vote on protocol changes, risk parameters, and stability mechanisms. As a critical part of DeFi infrastructure, MKR maintains its value through protocol utility and controlled supply mechanisms, such as token burns.

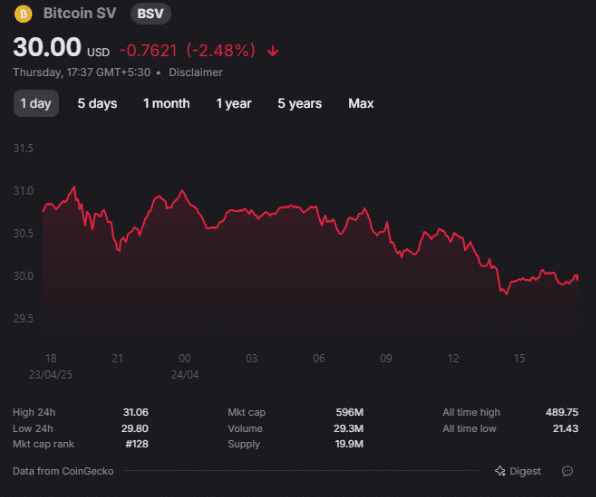

10. Bitcoin SV (BSV)

| Detail | Info |

|---|---|

| Price | $147.84 |

| Market Cap | $2.91 billion |

| Token Supply | 21 million |

| Blockchain | Bitcoin SV |

| Use Case | Peer-to-peer payments |

| Buy It Here | BSV |

Bitcoin SV (Satoshi Vision) sticks closely to Bitcoin’s original whitepaper, focusing on scalability and microtransactions. Despite controversies, BSV maintains a strong niche community and ecosystem. Its price reflects steady, if limited, adoption and a belief in its long-term potential.

Current Market Dynamics & Future Outlook

Bitcoin slipped below $92,500, despite reaching a two-month high above $93,000 earlier this week. The total cryptocurrency market capitalization currently stands at $2.76 trillion.

This recent surge in prices was fueled by easing US-China trade tensions and renewed investor confidence in the Federal Reserve’s leadership.

Ethereum and Solana also experienced notable gains alongside Bitcoin. So watch out for them too.

What’s Driving The Market?

Market sentiment remains heavily influenced by macroeconomic events and regulatory developments. Here are 2 important things to remember:

- Bitcoin’s momentum hints at a potential bullish trend.

- Some analysts suggest BTC could reach $100,000, reinforcing its top-tier status.

Important: This is not financial advice — always do your research before investing.

More Related Reads:

Conclusion: Bitcoin (BTC) Tops Crypto Price Chart At $92,559.36

As of April 2025, the top 10 most expensive cryptocurrencies continue to reflect a mix of high-value use cases, limited supply, and investor demand.

Bitcoin (BTC) leads at $92,559.36 with a market cap of $1.84 trillion, showcasing its dominance as the digital gold standard.

Meanwhile, wrapped versions like CBBTC and WBTC hover around the same price, expanding Bitcoin’s reach in DeFi.

The market’s bullish signals, fueled by macroeconomic events and possible Bitcoin momentum toward $100,000, signal an exciting phase for crypto investors.

Explore these high-value cryptos on platforms like Coinbase, Binance, and Kraken. Always DYOR (Do Your Own Research) and secure your assets in a trusted wallet.

FAQs

Wrapped versions like WBTC or CBBTC reflect real-time BTC value but may include slight premiums due to liquidity, demand, and platform-specific factors.

Not necessarily. Per-unit price reflects supply, not overall value. Market capitalization offers a clearer picture of a cryptocurrency’s real size.

Both are gold-backed tokens, but PAXG is issued by Paxos and regulated by NYDFS, while XAUt is issued by Tether with gold stored in Swiss vaults.

ULTIMA may not be widely available on mainstream exchanges due to its niche appeal and low circulation. Check its official website for availability.

While Bitcoin is a store of value, Ethereum powers smart contracts and dApps. Its utility and developer ecosystem make it second only to BTC in relevance.

![Crypto Tax Free Countries In 2025 [Updated List]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Crypto-Tax-Free-Countries-1-1024x536.png)

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)