Bitcoin isn’t backed by gold, government guarantees, or physical assets—it’s backed by trust, math, and adoption. The digital currency operates without central banks.

Its value comes from market demand, cryptographic proof, and a fixed supply of 21 million coins.

For those wondering “what backs cryptocurrency” or if “cryptocurrency is backed by anything,” this article explains the foundations of Bitcoin’s value system and why millions of people trust this digital asset despite its lack of traditional backing.

Let us get right into it!

The Truth About What Backs Bitcoin!

Bitcoin is not backed by any physical commodity, such as gold or silver, nor by any government-issued currency.

This fundamental difference often leads to the question of what backs cryptocurrency value? Bitcoin is backed by:

- Blockchain technology and cryptography

- Mathematical scarcity (21 million coin limit)

- Energy and computing power through mining

- Network effects and growing adoption

- Market consensus on its value

Understanding these elements helps explain why Bitcoin maintains its value despite lacking physical backing, such as gold or government guarantees.

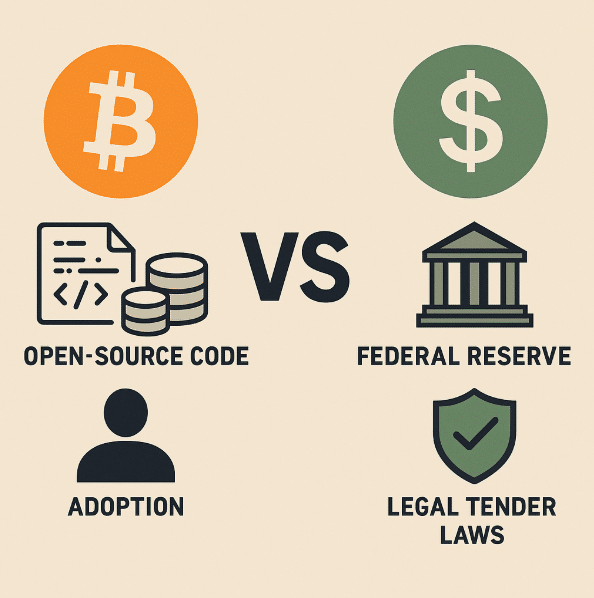

Unlike the U.S. dollar, which is backed by the Federal Reserve and legal tender laws, Bitcoin has no central authority or reserve. What gives it strength is its open-source code, scarcity model, and adoption.

Here is a difference between Traditional Backing vs. Bitcoin Backing:

| Traditional Currency Backing | Bitcoin Backing |

|---|---|

| Government guarantees | Mathematical scarcity |

| Gold reserves (historically) | Cryptographic security |

| Central bank policies | Decentralized consensus |

| Legal tender status | Network effects |

| Physical infrastructure | Energy investment through mining |

Why Does Bitcoin Have Value Without Traditional Backing?

Bitcoin’s value stems from scarcity (a 21 million coin cap), utility (facilitating cross-border payments), network effects (encompassing 300 million users), and energy investment (high mining costs that ensure security).

Here is what these 4 points mean in depth:

1. Scarcity

Bitcoin has a capped supply of 21 million coins. By March 2025, approximately 19.4 million bitcoins will have been mined, with the last expected to be mined around 2140. Making it precious.

2. Utility

Bitcoin enables cross-border payments without intermediaries, providing real value for global transfers outside traditional banking systems.

3. Network Effects

The more users there are, the more useful Bitcoin becomes. With 300 million worldwide, per Chainalysis data from 2024, Bitcoin sees significant network effects.

4. Energy Investment

The proof-of-work mining process incurs high energy costs, setting a cost floor for production and security.

What Backs Cryptocurrency: The Technology Factor

Bitcoin’s blockchain technology provides one of its strongest forms of backing. This distributed ledger records all transactions across thousands of computers worldwide, making it virtually impossible to alter records or counterfeit coins.

The cryptographic security behind Bitcoin means that even with today’s most powerful computers, breaking Bitcoin’s encryption would take centuries.

Research from MIT‘s Digital Currency Initiative shows that Bitcoin’s cryptographic foundation remains mathematically sound after 15 years of operation, with no successful attacks on its core protocol.

Is Cryptocurrency Backed By Anything Tangible?

Physical assets do not back Bitcoin, but this does not mean it lacks value foundations. The security and reliability of Bitcoin come from its decentralized blockchain, which requires significant energy and computing resources to maintain.

According to a 2023 University of Cambridge study, the Bitcoin network’s estimated annual electricity use of 184.63 TWh is roughly equivalent to the power consumption of a country like Argentina or enough to power over 17 million average U.S. households for a year.

This enormous energy investment represents a form of backing that secures the network against attacks.

Is Bitcoin Backed By Gold?

A common misconception reflected in search queries is whether there is bitcoin backed by gold. However, not all Bitcoin is backed by gold or any other commodity.

Some cryptocurrencies, known as stablecoins, are backed by assets such as dollars or gold. Gold-backed stablecoins are directly backed by physical gold reserves, with each token representing ownership of a specific amount of gold, combining cryptocurrency technology with traditional precious metal backing.

What Backs Cryptocurrency Value? (The Market Perspective)

From a market perspective, the value of cryptocurrency relies on participant consensus, similar to how markets value stocks, real estate, and art.

Bitcoin’s market capitalization surpassed $1 trillion at various points, reflecting substantial global confidence in its value. This confidence stems from community assessments of Bitcoin’s utility, not government mandates.

Research from Fidelity Digital Assets indicates that institutional investment in Bitcoin is increasing, with approximately 40% of surveyed investors in 2024 allocating funds to digital assets.

Who Created Bitcoin and Why Does It Matter?

Let’s delve into Bitcoin’s origin story, as it significantly influences trust in the system.

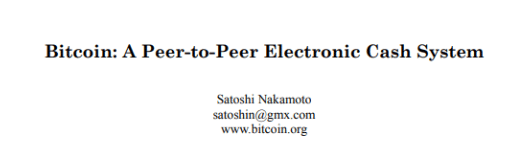

Bitcoin was launched by an anonymous individual or group known as Satoshi Nakamoto, who introduced the Bitcoin whitepaper in 2008.

Satoshi’s choice to remain anonymous and gradually withdraw from public life around 2011 reinforces Bitcoin’s credibility.

Unlike conventional currencies governed by identifiable authorities, Bitcoin operates without a central figure who can sway its evolution or monetary policy.

This decentralization means that Bitcoin’s value is derived from its code and community rather than the assurances of a central authority. This groundbreaking concept aimed to empower individuals by facilitating peer-to-peer transactions without the need for intermediaries.

The inception of Bitcoin marked the onset of a financial revolution, fostering hope for financial freedom and inclusivity in a world characterized by centralized control and economic disparity.

Read Next:

Conclusion: Understanding What Bitcoin Is Truly Backed By

When asking “what is bitcoin backed by,” the answer isn’t as simple as pointing to gold reserves or government guarantees. A combination of technological innovation, mathematical scarcity, network security, growing adoption, and market consensus backs Bitcoin.

While this form of backing differs fundamentally from traditional currencies, it has proven resilient over Bitcoin’s existence.

For investors and users wondering, “Is cryptocurrency backed by anything?” the answer is yes, but it represents a new paradigm in how we conceptualize value.

As cryptocurrency matures, understanding these non-traditional value foundations is crucial for anyone participating in this digital economic revolution.

FAQs

Secure purchases through established exchanges like Coinbase or Binance, using two-factor authentication and transferring to private wallets for long-term storage.

Mining is the process of validating transactions and securing the Bitcoin network using specialized computers, receiving newly created Bitcoin as a reward.

Bitcoin typically shows higher volatility than stocks or bonds, with potential price swings of 5-10% daily versus 1-2% for traditional markets.

Governments can regulate exchanges and tax Bitcoin, but its decentralized nature makes a complete ban technically difficult to enforce.

Miners will shift to earning transaction fees rather than block rewards, potentially increasing Bitcoin’s value if demand continues to grow.

![Crypto Tax Free Countries In 2025 [Updated List]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Crypto-Tax-Free-Countries-1-1024x536.png)

![Top 15 Crypto Podcasts to Listen to in 2025 [Popular]](https://crypto.prosperityforamerica.org/wp-content/uploads/2025/03/Best-Podcasts-on-Cryptocurrency-1024x536.png)