What began as a single digital asset in 2009 has grown into a vast market with over 17,000 cryptocurrencies in circulation as of 2025.

However, only a fraction hold real value, with Bitcoin and Ethereum dominating nearly 75% of the market.

The global crypto market cap stands at $2.96 trillion, reflecting both growth and volatility. While over 50% of all cryptocurrencies have failed, innovation continues.

Exchanges like Binance lead the industry, and 28% of American adults now own digital assets. As adoption rises, blockchain technology is set to shape the future of finance. Find more details below!

Top Picks: How Many Cryptocurrencies Are There?

- As of 2025, 17151 cryptocurrencies are in existence. (Coin Gecko) However, the majority have low market significance.

- Bitcoin and Ethereum together account for nearly 75% of the total cryptocurrency market cap, highlighting the market’s concentration.

- As of 2025, Bitcoin (BTC) remains a “high cap” asset, with a market capitalization exceeding $10 billion, signifying its dominance in the crypto space. (Statista)

- 217 cryptocurrency exchanges exist worldwide in 2025. (Coin Gecko)

- The global cryptocurrency market cap stands at $2.96 trillion, reflecting both rapid growth and extreme volatility. (Coin Gecko)

- The worldwide cryptocurrency market is expected to generate $45.3 billion in revenue in 2025. The penetration rate is estimated at 11.02% worldwide by the end of 2025. (Statista)

- As of 2025, over 50% of all cryptocurrencies have failed. (Coin Gecko)

How Many Cryptocurrency Exchanges Are There?

- As of 2025, there are 217 cryptocurrency exchanges worldwide.

SuperEx is the largest cryptocurrency spot exchange in the world by trading volume, with $163.61 billion in trades within 24 hours. Binance, once the dominant exchange, ranks second with $15.41 billion in 24-hour trading volume.

Here’s a table of the top 10 cryptocurrency exchanges based on 24-hour trading volume as of 2025:

| Exchange | 24h Trading Volume (in Billion USD) |

|---|---|

| SuperEx | 163.61 |

| Binance | 15.41 |

| 4E | 3.52 |

| BiFinance | 3.32 |

| HTX | 2.99 |

| Darkex Exchange | 2.95 |

| Zedcex Exchange | 2.59 |

| Bybit | 2.47 |

| MEXC | 2.45 |

| OKX | 2.30 |

Cryptocurrency Market Size (2025-2030)

- As of 2025, the global cryptocurrency market cap today is $2.96 trillion.

- The peak Cryptocurrency market cap appears to be around $4 trillion, reached in late 2024.

- The lowest market cap in the last decade was before 2017, when the total market cap remained under $100 billion.

Here is a year-wise breakdown of the total cryptocurrency market capitalization:

| Year | Approx. Cryptocurrency Market Cap |

|---|---|

| 2015 | <$10 billion |

| 2016 | ~$15 billion |

| 2017 | ~$600 billion (Dec peak) |

| 2018 | ~$130 billion (Bear market low) |

| 2019 | ~$250 billion |

| 2020 | ~$750 billion (End of year) |

| 2021 | ~$3 trillion (Nov peak) |

| 2022 | ~$800 billion (Bear market low) |

| 2023 | ~$1.8 trillion |

| 2024 | ~$4 trillion (Peak) |

| 2025 | ~$2.96 trillion (Current) |

- By 2030, the cryptocurrency market is expected to reach USD 69.39 billion, reflecting a compound annual growth rate (CAGR) of 7.11%. (Mordor Intelligence)

Growth Of Crypto Coins Over The Years

- The global cryptocurrency user base grew the most by nearly 190% between 2018 and 2020. (Statista)

- As of January 30, 2025, Bitcoin (BTC) reached a price of $105,510, marking a 12.5% increase over the past 30 days. 30 days ago, Bitcoin was approximately $93,800.

- Ethereum (ETH) was priced at $3,217.96, reflecting a 4.6% drop in the past month.

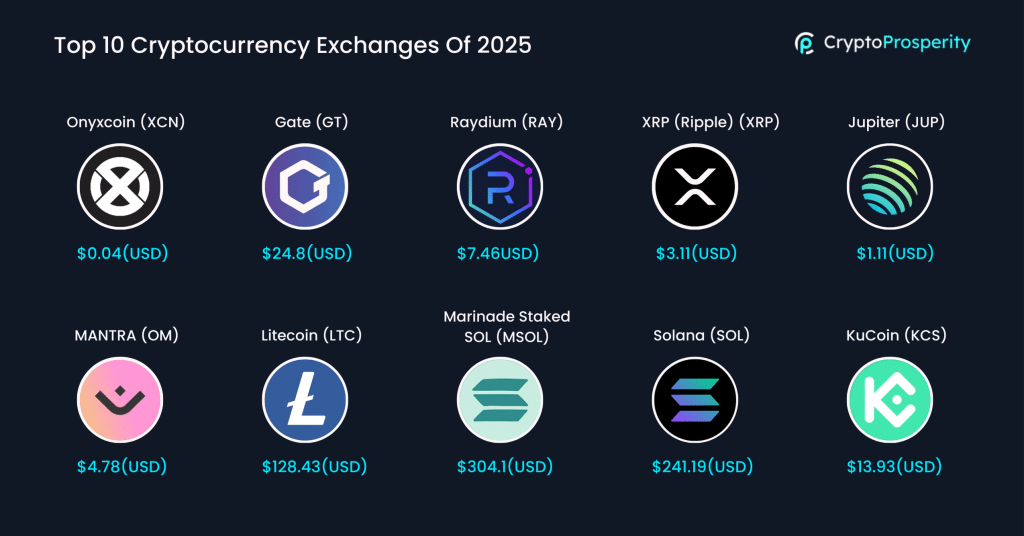

Top 10 Performing Cryptocurrencies (30-Day Change) as of January 30, 2025:

| Rank | Cryptocurrency (Symbol) | Price (USD) | 30-Day % Change |

|---|---|---|---|

| 1 | Onyxcoin (XCN) | $0.04 | +1,550.7% |

| 2 | Gate (GT) | $24.8 | +55.1% |

| 3 | Raydium (RAY) | $7.46 | +51.7% |

| 4 | XRP (Ripple) (XRP) | $3.11 | +50.8% |

| 5 | Jupiter (JUP) | $1.11 | +35.3% |

| 6 | MANTRA (OM) | $4.78 | +34.2% |

| 7 | Litecoin (LTC) | $128.43 | +28.6% |

| 8 | Marinade Staked SOL (MSOL) | $304.1 | +26.7% |

| 9 | Solana (SOL) | $241.19 | +25.8% |

| 10 | KuCoin (KCS) | $13.93 | +30.0% |

(Statista)

- Bitcoin remains the most widely held cryptocurrency, owned by 74% of crypto investors.

- Ethereum ownership has declined from 65% in 2022 to 49% in 2025.

- Dogecoin ownership has increased to 31%, surpassing Solana (18%) and USDC (17%).

- 66% of people planning to buy crypto in 2025 want Bitcoin, followed by Ethereum (43%) and Dogecoin (24%).

- Solana has gained traction, with 17% of crypto buyers planning to invest in it this year.

- Ethereum recorded over 39 million on-chain transactions in December 2024, making it the most-used cryptocurrency that month.

- Bitcoin processed 12.7 million transactions in the same period, about one-third of Ethereum’s transaction volume.

(Statista)

Types of Cryptocurrency & Their Statistics

There are 12 types of Cryptocurrencies, and here are statistical facts about them:

1. Payment Cryptocurrencies

These are designed to function as digital money for transactions. (Examples: Bitcoin (BTC), Litecoin (LTC), Bitcoin Cash (BCH), Dash (DASH))

- Bitcoin (BTC) remains the largest payment-focused cryptocurrency, with a market cap of $1.75 trillion as of March 2025.

- Litecoin (LTC), often called the silver to Bitcoin’s gold, has a total supply of 84 million coins, four times that of Bitcoin.

2. Stablecoins

These are pegged to a stable asset like the U.S. dollar to minimize volatility. Examples: Tether (USDT), USD Coin (USDC), Dai (DAI), Binance USD (BUSD)

- Tether (USDT) is the most dominant stablecoin, with a market cap of $142.69 billion, making it the fourth-largest cryptocurrency overall.

- USD Coin (USDC) holds a $57.23 billion market cap and claims to be 100% backed by reserves.

3. Smart Contract Platforms

(These blockchains support decentralized applications (DApps) and automated contracts. Examples: Ethereum (ETH), Solana (SOL), Cardano (ADA), Avalanche (AVAX)

- Ethereum (ETH) leads this category with a $264.67 billion market cap and processes over 1 million transactions daily.

- Solana (SOL) boasts 65,000 transactions per second (TPS), making it one of the fastest blockchain networks.

4. Privacy Coins

These focus on enhanced anonymity and untraceable transactions. Examples: Monero (XMR), Zcash (ZEC), Dash (DASH), Verge (XVG)

- Monero (XMR) transactions are fully anonymous, with over 95% of transactions on its network being shielded from public view.

- Zcash (ZEC) offers optional privacy features and has been used in over 20 million transactions since its launch.

5. Utility Tokens

These provide access to specific services within a blockchain network. Examples: Chainlink (LINK), Binance Coin (BNB), Uniswap (UNI), Filecoin (FIL)

- Binance Coin (BNB) has a market cap of $84.33 billion and is widely used for trading fee discounts on Binance.

- Chainlink (LINK), a leading oracle network, has facilitated over $500 billion in innovative contract transactions.

6. Governance Tokens

These allow holders to vote on changes to a blockchain’s protocol. Examples: Maker (MKR), Aave (AAVE), Compound (COMP), Curve DAO (CRV)

- Maker (MKR) holders manage over $8 billion in assets within the MakerDAO ecosystem.

- Aave (AAVE) governance decisions impact a DeFi lending market worth over $10 billion.

7. Exchange Tokens

Issued by cryptocurrency exchanges, these tokens provide trading fee discounts and rewards. Examples: Binance Coin (BNB), FTX Token (FTT), OKB (OKB), KuCoin Token (KCS)

- Binance Coin (BNB) is the most valuable exchange token, worth $84.33 billion, and it is used for transaction discounts and payments.

- OKB (OKX Exchange token) has seen over 200% price growth in the last two years.

8. Meme Coins

These started as jokes but have gained value due to community support. Examples: Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Floki Inu (FLOKI)

- Dogecoin (DOGE), originally a joke, now has a market cap of $29.84 billion and is used for payments, including Tesla merchandise.

- Shiba Inu (SHIB) has over 1.3 million holders, making it one of the most widely held meme tokens.

9. Gaming & Metaverse Tokens

Used in virtual worlds, gaming platforms, and NFT-based economies. Examples: Decentraland (MANA), Axie Infinity (AXS), The Sandbox (SAND), Gala (GALA)

- Since its launch, the Sandbox (SAND) has powered $500 million worth of virtual land sales.

- Axie Infinity (AXS) once processed $3 billion in NFT transactions in a year.

10. Layer 2 & Scaling Solutions

These improve blockchain efficiency by reducing transaction costs and congestion. Examples: Polygon (MATIC), Optimism (OP), Arbitrum (ARB), Loopring (LRC)

- Polygon (MATIC) processes more than 2.3 million daily transactions, reducing Ethereum gas fees significantly.

- Arbitrum (ARB) holds over $10 billion in total value locked (TVL) in DeFi protocols.

11. Central Bank Digital Currencies (CBDCs)

Government-issued digital currencies backed by national banks. Examples: Digital Yuan (e-CNY), Digital Euro, Digital Rupee, FedNow (U.S. proposal)

- China’s Digital Yuan (e-CNY) has over 260 million users and has completed $14 billion worth of transactions.

- More than 130 countries are exploring CBDCs, representing 98% of the global GDP.

12. Asset-Backed & Commodity Tokens

These represent ownership of real-world assets like gold, real estate, or stocks. Examples: Paxos Gold (PAXG), Tether Gold (XAUT), Synthetix (SNX), Wrapped Bitcoin (WBTC)

- Paxos Gold (PAXG) represents over $500 million in gold-backed assets on the blockchain.

- Wrapped Bitcoin (WBTC) has a circulating supply of over 160,000 BTC, bridging Bitcoin to Ethereum-based DeFi platforms.

(Coin Market, Coin Gecko, Etherescan, Bankrate, DefiLlama, PBC)

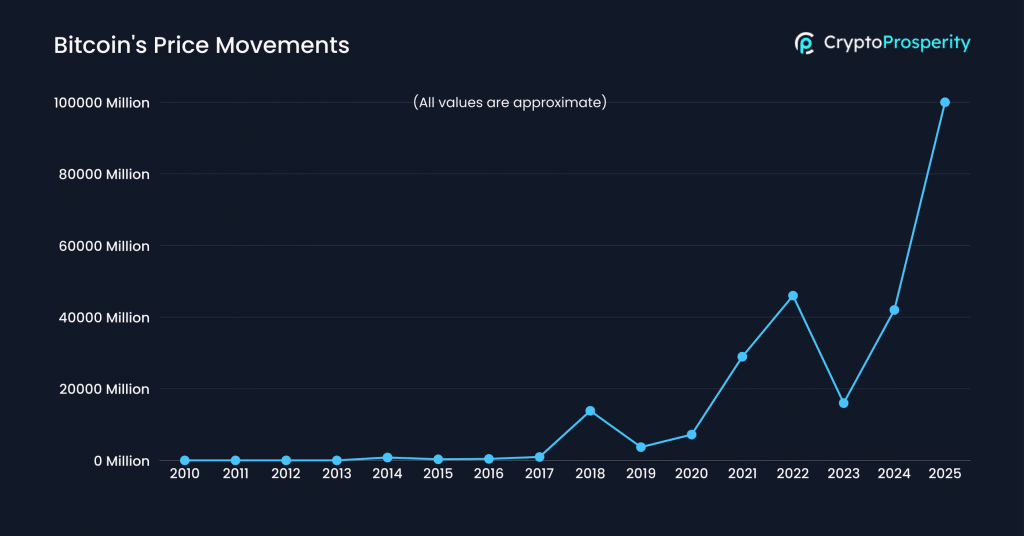

When Was Bitcoin Launched? (Bitcoin Statistics)

- Bitcoin was officially launched on January 3, 2009, by Satoshi Nakamoto, an anonymous creator or group.

- Bitcoin has seen multiple boom-and-bust cycles, often dropping 50-90% before rebounding stronger.

- In December 2024, Bitcoin crossed $100,000 for the first time, thanks to Donald Trump’s pro-crypto policies after his reelection.

- However, Bitcoin faced volatility in early 2025, dropping after announcing a Strategic Bitcoin Reserve.

- Bitcoin broke $100 for the first time in April 2013 and surged to over $1,200 by December.

- A 90% crash followed in 2014, largely due to the infamous Mt. Gox exchange collapse, dropping Bitcoin to $111 before rebounding to $430 by 2015.

- By 2017, Bitcoin skyrocketed past $10,000 in November, peaking at $19,000+ in December due to mainstream investor interest and hype.

Here’s a year-wise table summarizing Bitcoin’s historical price movements and returns:

| Year | Price at Start | Price at End | Return (%) |

|---|---|---|---|

| 2009 | N/A | N/A | N/A |

| 2010 | ~$0.00099 | ~$0.30 | 30,203%* |

| 2011 | ~$0.30 | ~$4.70 | 1,467% |

| 2012 | ~$4.70 | ~$13.50 | 187% |

| 2013 | ~$13.50 | ~$805 | 5,870% |

| 2014 | ~$805 | ~$318 | -61% |

| 2015 | ~$318 | ~$430 | 35% |

| 2016 | ~$430 | ~$960 | 124% |

| 2017 | ~$960 | ~$13,850 | 1,338% |

| 2018 | ~$13,850 | ~$3,709 | -73% |

| 2019 | ~$3,709 | ~$7,200 | 94% |

| 2020 | ~$7,200 | ~$28,949 | 302% |

| 2021 | ~$28,949 | ~$46,000 | 60% |

| 2022 | ~$46,000 | ~$16,000 | -65% |

| 2023 | ~$16,000 | ~$42,000 | 163% |

| 2024 | ~$42,000 | ~$100,000+ | 138%+ |

| 2025 | ~$100,000+ | N/A | N/A |

Crypto Usage Demographics

- 28% of American adults (65 million people) own cryptocurrency in 2025, nearly doubling from 15% in 2021.

- 67% of crypto owners are men, while 33% are women.

- The median age of crypto owners is 45.

- 14% of non-owners plan to enter the crypto market in 2025, and 48% are open to doing so.

- 67% of current crypto holders plan to buy more this year.

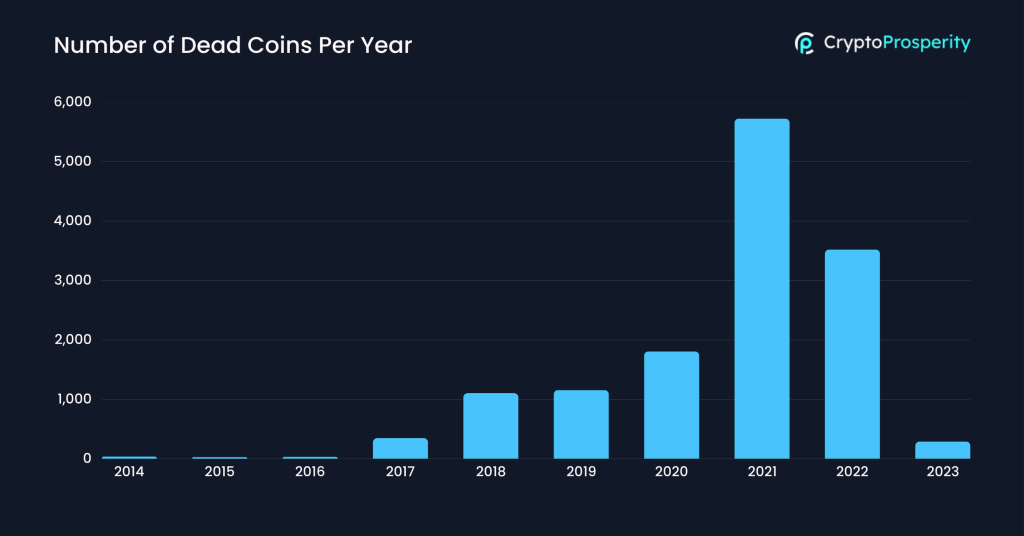

How Many Cryptocurrencies Have Failed?

- Over 50% of Cryptocurrencies Have Failed.

- Since 2014, 14,039 of 24,000+ cryptocurrencies listed on CoinGecko have become inactive or “dead.”

- 2021 had the most Cryptocurrencies failures (5,724 projects dead, ~70% failure rate).

Here’s a table summarizing the cryptocurrency failure data:

| Year of Launch | Number of Dead Coins | Failure Rate |

|---|---|---|

| 2014 | 37 | Low |

| 2015 | 27 | Low |

| 2016 | 32 | Low |

| 2017 | 346 | ~70% |

| 2018 | 1,104 | ~70% |

| 2019 | 1,154 | Moderate |

| 2020 | 1,806 | Moderate |

| 2021 | 5,724 | ~70% |

| 2022 | 3,520 | ~60% |

| 2023 | 289 | <10% |

Crypto Concerns in 2025

- 59% of people familiar with crypto lack confidence in its security, including 40% of crypto owners.

- Nearly 1 in 5 crypto owners have struggled to withdraw funds from custodial platforms.

- 39% of non-owners cite unstable value as their top concern, while 32% of owners fear cyberattacks.

- 93% of respondents are based in Europe, Asia, North America, and Africa, highlighting global interest in Crypto AI.

- 53% of participants are in their first crypto cycle (0-3 years in crypto), indicating that many respondents are relatively new to the space.

- In 2025, 51% of crypto users identified as long-term investors, while 26% were short-term traders.

The Future of Cryptocurrencies

- Cryptocurrency adoption in payments remains minimal, with forecasts predicting it will account for only 0.2% of global transaction value by 2027. (Statista)

- The number of cryptocurrency users is projected to reach 861.01 million in 2025. However, the penetration rate is estimated at 11.02% worldwide in 2025.

- The United States will contribute the highest revenue, projected at $9.4 billion by the end of 2025.

(Statista)

Also Read:

Will Crypto Change Under the Trump Administration?

- 60% of Americans familiar with crypto expect its value to increase under Trump’s presidency.

- 46% believe Trump will boost mainstream adoption of cryptocurrency.

- 28% support the creation of a national Bitcoin reserve, rising to 44% among current crypto owners.

- Only 24% trust the government to regulate cryptocurrencies effectively.